PepsiCo (NASDAQ:PEP) delivered another batch of solid quarterly results and closed the books with yet another year of double-digit earnings growth.

In prior quarterly coverage on PEP, I maintained a bullish posture on the stock. In Q3, I noted that the company had a clear path to their 10% organic revenue growth target. I also highlighted strength in key brands such as Doritos and Cheetos, as well as their strong international growth prospects. The moderation in PEP’s overall Frito-Lay division, however, led me to scale back my price target on the stock to the $190/share range.

Following today’s release, I believe a path to $200/share exists. In Q4, the company reported mixed results with a miss on the topline. But this was due primarily to the effects of a recall in their Quaker Foods unit. Organic sales, otherwise, reported continued growth, with notable strength in their international markets.

Profits also continue to impress on continued pricing power, which resulted in double-digit earnings growth for the year. In my view, I can see Pepsi generating about $8.30/share in core EPS in 2024, representing an upper-single-digit percentage increase. I believe the continued profitability strength reaffirms the bullish view on PEP.

New Developments With Pepsi Since Q3

There was no shortage of headlines since last October. Shortly after the company’s third quarter release, PepsiCo announced that its well-respected CFO, Hugh Johnson, would be leaving to join Disney (DIS). Since his start at DIS, shares are up 22% YTD. He either simply joined at the right time or the company was due for a significant reassessment after trading in the shallows for much of last year. At any rate, shares in PEP are up just 2% over the same period. It’s worth noting, too, that Johnson had also disclosed the sale of over +$8M in PEP shares in the last filing period.

PEP has also begun to face backlash over its pricing power. Most notably, European supermarket chain Carrefour removed the company’s products from its shelves in protest over the company’s “unacceptable price increases”, according to the company’s post on products already on its shelves. Granted, the loss would represent just a small fraction of the company’s total global sales.

In better news, Celsius Holdings (CELH), recently announced its international expansion into Canada. The fast-growing company’s entrance into a new operating market is notable, given PEP’s stake in the company. In my view, PEP’s interest in CELH, and CELH’s intriguing prospects, is perhaps one catalyst that could take PEP to the $200/share mark.

PEP Q4 Results Recap

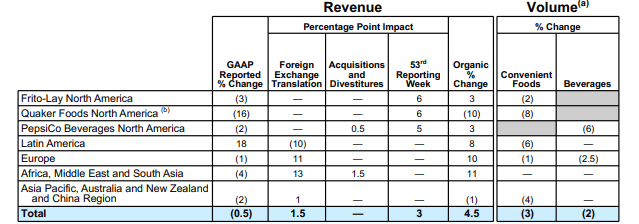

PEP reported 4.5% organic revenue growth in Q4, led by strength in their international business, which reported double-digit organic growth in Europe and AMESA. PEP also reported growth in FLNA and their namesake units, but they notably reported a 10% decline in Quaker Foods. This was due primarily to the negative impact of product returns from the Quaker recall, as well as the lost future sales.

Consistent with prior quarters, PEP’s organic revenue gains were driven by price, with units continuing again in the negative in Q4. While this is indicative of Pepsi’s continued pricing power, both consumers and supermarkets appear to be pushing back against higher prices, especially as the overall inflation rate continues to decline.

PEP Q4 Earnings Release – Summary Of Revenue Growth By Unit

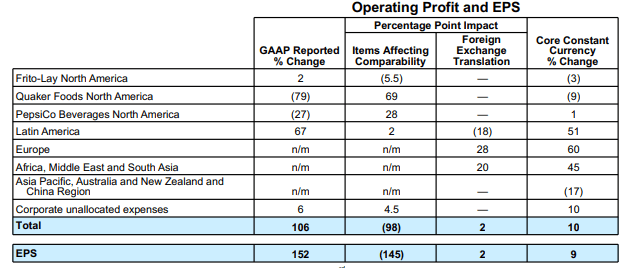

For the quarter, PEP grew core EPS by 9% YOY. This contributed to a double-digit annual increase of 14%. Profit was particularly strong in Latin America as PEP benefitted from net pricing actions, which more than offset organic volume declines and higher operating costs.

The impacts of the Quaker recall clearly weighed on overall profitability during the quarter. Operating profit was down 79% and 9% on a GAAP and core basis, respectively. This represents a significant swing from last quarter’s double-digit gains in both metrics. PEP’s namesake also created a drag during the quarter due to a combination of impairment-related charges and higher operating costs. Despite the headwinds, PEP still turned in stronger than expected profit during the quarter.

PEP Q4 Earnings Release – Summary Of Earnings Growth By Unit

PEP Outlook & Guidance

Looking ahead to FY24, PEP guided for a 4% increase in organic revenue and an 8% increase in core EPS, in-line with prior targets.

In my view, I believe the 8% EPS target is a bit conservative, as I believe declining input costs may create a tailwind towards the back half of the fiscal year. As it stands, PEP is implying 2024 core EPS of $8.15/share. I can see earnings landing instead near the $8.30/share mark.

PEP also announced a 7% increase in their dividend payout to an annualized rate of $5.42/share. The increase marks the company’s 52nd consecutive year of increases, a testament to PEP’s impeccable financial foundation.

Is PEP Stock A Buy, Sell, Or Hold?

Shares in PEP are underperforming the broader market. The stock is essentially trading at the same level that it was last year, while the overall S&P has gained more than 20% over the same period. Pepsi could also be viewed as a company in transition. Late in 2023, former CFO Hugh Johnson left the company to join Disney. Aside from the change in leadership, evolving trends in weight loss also pose a threat to Pepsi’s more indulgent product offerings. And for still others, there’s perhaps little value to be seen in PEP’s current trading multiple.

Despite the uncertainties, PEP remains a solid long-term buy, in my view. Much had been highlighted previously about the loss of Carrefour, but when considered in perspective, the loss represented just a fraction of the company’s total global revenue. Pepsi’s leadership position and size affords them the cushion to absorb these losses without really creating a blip on the topline.

Pepsi’s growing global exposure also serves as a hedge against the rising popularity of weight loss drugs in their U.S. market. While changing behavioral health habits at home may result in lost sales to a degree, this would likely be offset by gains in emerging markets, such as India, Mexico, and Brazil.

And with regards to the changeover in the top-level finance position, it’s worth noting that new CFO, Jamie Caulifield, had a strong run at PEP’s food business, where he oversaw continued growth at Frito and Quaker, leading it to near-parity with the company’s namesake unit.

I’ve maintained in prior coverage that PEP would be fairly valued at the $200/share mark. I remain bullish today and still see shares reaching the target over the medium to long-term. While the current average Wall Street target stands at around $190/share, some are much more bullish. Analysts at Bank of America (BAC), for example, have a target of $210/share on PEP.

By my estimates, I can reasonably see PEP generating 2024 core EPS of about $8.30/share. This would be about 10% above 2023 levels. I believe this is attainable, as PEP has had a strong run of under promising and overdelivering. This was reflected this past quarter as earnings still came in ahead of estimates despite the negative impacts of a product recall.

Expansion in their carbonated business through Celsius may be one catalyst. Increasing reach internationally could be another. At 25x estimated EPS, PEP could command a price point of $208/share. Averaged out against estimates elsewhere would bring the target down to $200/share, which would still represent nearly 15% upside from current trading levels. Ultimately, I believe this warrants a continued bullish perspective on the stock.