Karl Hendon/Moment via Getty Images

Investment thesis

Our current investment thesis is:

- NV5 (NASDAQ:NVEE) is a fantastic company, illustrated by its impressive share price performance (+1k%). It is extremely well-rounded in its expertise, allowing the company to scale in the projects it is delivering and also expand the services it can offer its clients. We see numerous industry tailwinds that should support long-term growth, with its position allowing NV5 to gain market share and enjoy an outsized portion of this spending.

- The company’s capital allocation is a concern but we would like to see a period of operational improvement and execution before judging too harshly, as the business moves toward a mature level.

- At a FCF yield of ~8%, we believe the business is attractively valued. Its valuation does not scream undervalued in our view, and so investors would do well to progressively build a position if interested, but we see sufficient near-term resilience to initiate at a buy.

Company description

NV5 Global, Inc. (NVEE) is a leading provider of professional and technical engineering and consulting services, offering solutions to public and private sector clients in the infrastructure, construction, real estate, and environmental markets. With a diverse portfolio, NV5 is renowned for its innovative approach, ensuring sustainable, efficient, and cost-effective project outcomes.

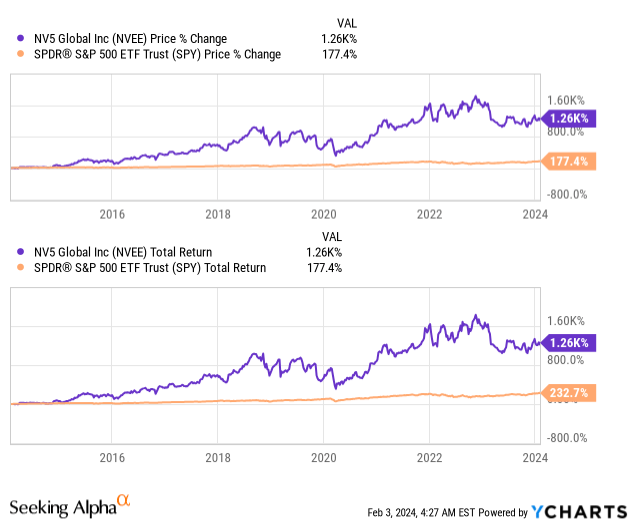

Share price

NV5’s share price performance has been incredible, returning over 1k% to shareholders during the last decade. This has been driven by an aggressive growth strategy and its relatively small base from which it has expanded.

Financial analysis

Capital IQ

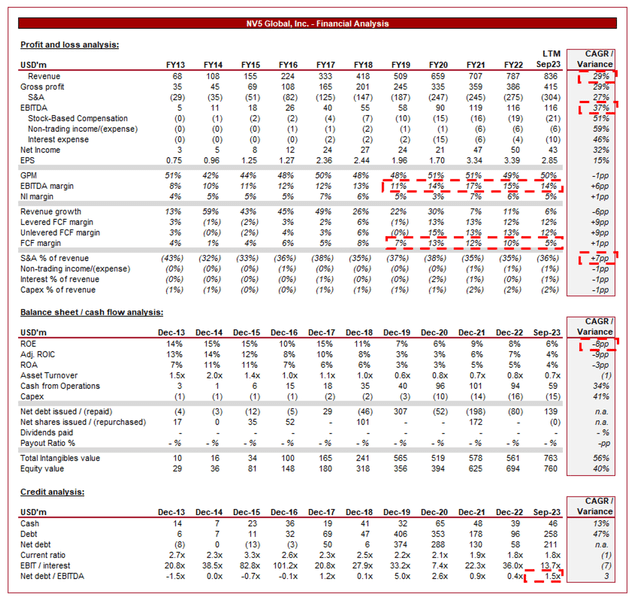

Presented above are NV5’s financial results.

Revenue & Commercial Factors

NV5’s revenue has grown impressive, with a CAGR of +29% into the LTM period. In conjunction with this, EBITDA has grown +37%, as Management has executed an aggressive expansion strategy.

Business Model

NV5 offers a wide range of services, including engineering, consulting, and technical services. Its diversified service portfolio allows them to cater to various sectors within the infrastructure and construction industry, while developing a wide area of expertise.

NV5 concentrates on specialized and high-growth segments, such as renewable energy, transportation, healthcare, and water resources, where clients require ongoing support in areas of technical complexity. By targeting these segments, NV5 positions itself well to be a long-term partner in the provision of invaluable support.

NV5 actively pursues government contracts and engages in public-private partnerships (PPPs). Government-funded projects, especially in areas like infrastructure development, provide a stable revenue source given their recurring and long-term nature. This also provides the benefit of acting as proof of capabilities to the private sector, which will increasingly be the area of focus as Government budgets are inherently limited.

NV5 has expanded geographically, both within the United States and internationally. Establishing a presence in different regions allows it to diversify its revenue sources and mitigate risks associated with economic fluctuations in specific areas. Most importantly we feel, this allows NV5 to exploit infrastructure growth in particular markets, utilizing the brand it has developed within the US. Naturally, the expectation is for emerging markets to modernize their infrastructure as economic growth is achieved, contributing to superior spending to the West.

NV5 has pursued its growth strategy partially through strategic acquisitions. It has acquired firms that complement its existing services or provide entry into new geographies/market segments. From a strategic perspective, this has enhanced the company well and positioned it for sustainable long-term growth regardless of cyclicality and tailwinds.

Growth prospects

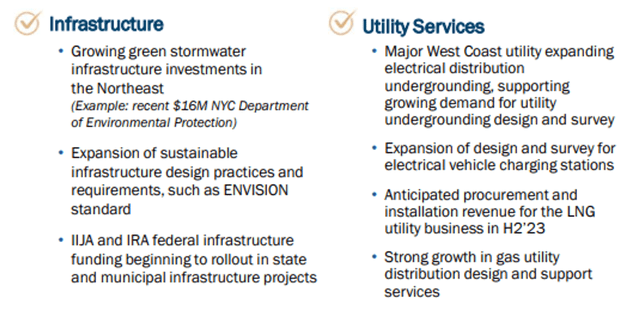

We believe NV5 is positioned well to achieve strong organic growth in the coming years, principally due to the following factors:

- Infrastructure Modernization – Increasing investments in aging infrastructure in the West are driving demand within the industry. The West has neglected its infrastructure for decades growth has exceeded its ability to invest and public finances have tightened. The US is leading the charge with the IIJA but many other nations are aware and actioning this issue. We consider this the most important near-term headwind. From the opposing perspective, emerging markets will also invest well as we have discussed, allowing for the potential of a double benefit.

NV5

- Renewable Energy Projects – Most nations of sufficient scale are committed to an energy transition within the coming decades, contributing to significant investment in their energy infrastructure. Expansion into solar, wind, and hydroelectric projects is growing rapidly and has a long runway.

- Niche Specialization – By concentrating on specialized segments, NV5 taps into markets with consistent project flow and demand for deep expertise. Its clients are unable to efficiently operate within these segments without this support, creating dependency and demand. These businesses do not have the ability or motivation to “in-house” these services due to a lack of sufficient scale to justify the cost and an inability to attract the necessary talent.

- Innovation – Emerging technologies and the growing importance of this in all facets of society have increased the importance of utilizing consultants to ensure businesses are operating in the most efficient and “forward” manner, to maintain and grow their competitive advantages.

Margins

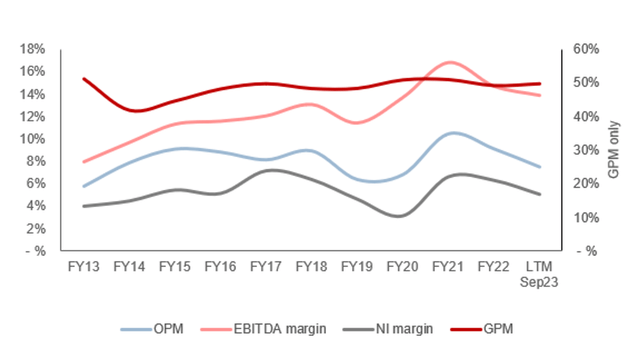

Capital IQ

NV5’s margins have developed well during the last decade, although not materially so when contextualized by the degree to which revenue has increased. From an absolute basis, the ability to consistently generate an EBITDA-M above ~12% is a reflection of its strong value proposition and

Margin improvement has been driven principally by its scale, with S&A spending declining as a % of revenue from 43% to 36% (-7ppts), while GPM has been flat. This is operating cost leverage, although the scope for additional gains is diminishing, with ~35% level being a reasonable medium-term target.

The labor-intensive nature of its services means the company is restricted in its ability to price significantly above the compensation it provides to employees, otherwise faces labor churn and lost talent. Nevertheless, we believe its current profitability is highly attractive.

Quarterly results

NV5’s recent performance continues to be strong, although has marginally softened relative to prior years. Its top-line revenue in the last four quarters was +0.7%, (3.1)%, +9.8%, and +17.3%. In conjunction with this, margins have been broadly stable, although have slightly ticked down on an EBITDA-M basis.

Given the contractual nature of the business, timing issues can contribute to occasional quarters of negative growth. The broader revenue trajectory of the company remains extremely positive, which is fundamentally the more important story (rather than individual quarters).

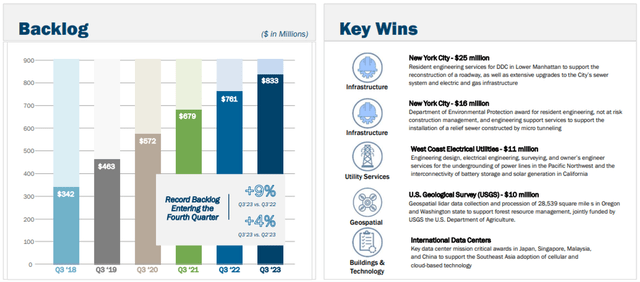

This performance is impressive given the wider macroeconomic environment. With elevated rates and inflation, we are seeing economic conditions soften and investors turn conservative. This uncertainty, in conjunction with elevated funding requirements, is negatively impacting the infrastructure industry yet NV5 has been able to remain insulted thus far. This is primarily due to the long-term nature of its contracts and projects, as well as its strong backlog. The company is essentially lagging behind the environment. As the following illustrates, backlog continues to grow to record levels as new contracts are won.

NV5

Looking ahead, we expect economic conditions to remain difficult, which implies a knock-on impact will eventually be felt by NV5. Timing is critical, however, as NV5 could get away with only a revenue softening if the recovery is sufficiently quick. Although this is uncertain, we are not concerned about its medium-term trajectory, which is more important and remains healthy.

Balance sheet & Cash Flows

NV5 is conservatively financed, with a ND/EBITDA ratio of 1.5x. Interest currently represents 1% of revenue, with a coverage of 14x. This positions the business well to continue to execute its current capital allocation strategy.

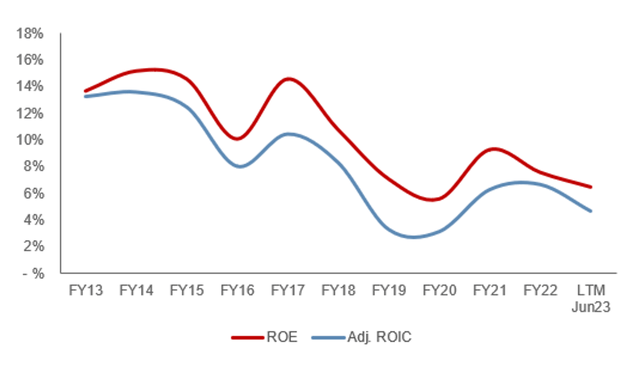

Although we have praised its M&A strategy from a commercial perspective, it leaves a lot to be desired from a financial one. When considering M&A, investors and Management teams are far too focused on it being margin accretive/neutral from a financial perspective, and not sufficiently on it being ROE accretive. NV5 NIM has remained flat while EBITDA has improved, implying its acquisitions have met the first criteria. Despite this, ROE has consistently declined, principally due to its ballooning balance sheet (Goodwill on acquisition). We would not be aggressive enough to suggest Management is overpaying for acquisitions but it is certainly paying considerably for them. Incremental returns for existing shareholders have thus declined relative to its capital. NV5 has declined from a market-beating ~14% to ~6%, which is below the long-term average return of the S&P 500. We believe the following Charlie Munger quote tells this story perfectly.

Over the long term, it’s hard for a stock to earn a much better return than the business which underlies it earns. If the business earns 6% on capital over 40 years and you hold it for that 40 years, you’re not going to make much different than a 6% return — even if you originally buy it at a huge discount. Conversely, if a business earns 18% on capital over 20 or 30 years, even if you pay an expensive-looking price, you’ll end up with one hell of a result.

Capital IQ

Outlook

Capital IQ

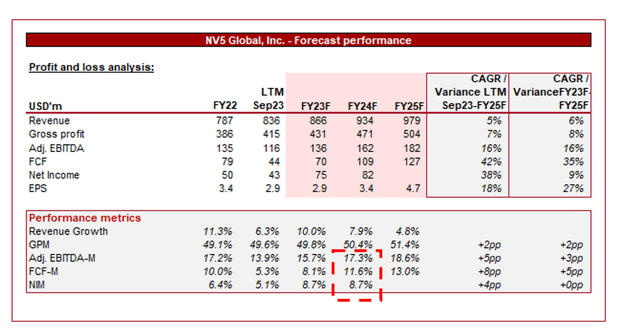

Presented above is Wall Street’s consensus view on the coming years.

Analysts are forecasting a slowdown in the company’s revenue trajectory, with a CAGR of +5% into FY25F. In conjunction with this, margins are expected to sequentially improve, although not materially so.

We concur with these forecasts on an organic basis. The company has opportunistically acquired companies, with the financial contribution increasingly diluted given its larger scale. It is likely analysts have not forecast any material transactions, and thus assume a MSD organic rate and LSD contribution from M&A, which we see as reasonable.

Further, continued benefits from operating cost leverage, as well as a greater focus on higher value services, such as those that are software-enabled, should allow for margin improvement.

Industry analysis

Seeking Alpha

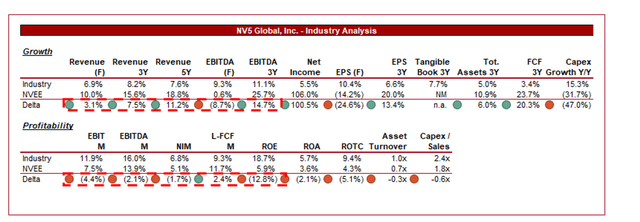

Presented above is a comparison of NV5’s growth and profitability to the average of its industry, as defined by Seeking Alpha (28 companies).

NV5 performs well relative to its peers, although is lacking to a greater degree than expected given its share price performance. The company’s growth is its key strength, with a significant outperformance across key metrics and timeframes. This is attributable to both M&A and the benefits of tailwinds. NV5 is a compelling proposition within its niche and so the improvement in growth has allowed it to capture a lucrative share.

NV5 is lacking in margins, however. We attribute this to two key factors. Firstly, the company’s size given its niche nature limits its scale benefits relative to peers. Secondly, the peer group includes a number of SaaS/Software-enabled businesses that operate with the substantial margins that come with that. On a FCF basis, the company is strong. We are more concerned by the degree to which it underperforms on a ROTC/ROE basis.

Valuation

Capital IQ

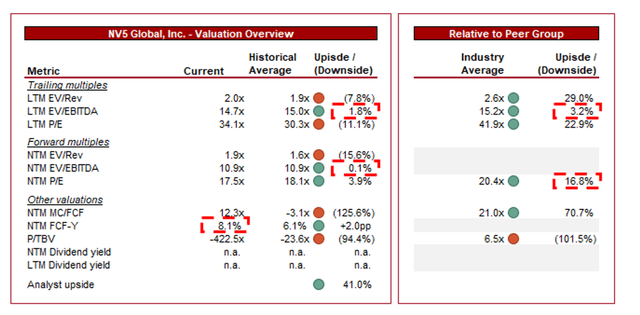

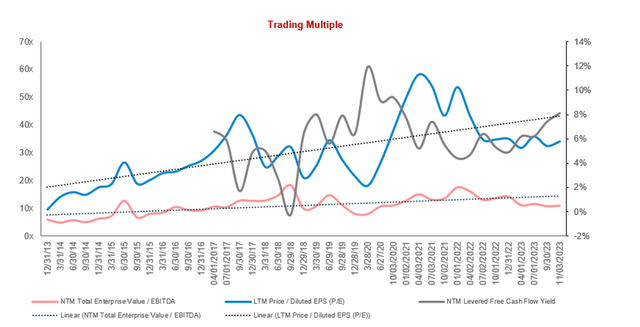

NV5 is currently trading at 15x LTM EBITDA and 11x NTM EBITDA. This is broadly in line with its historical average, reflecting the share price performance alignment to its profitability growth.

We believe NV5 should be trading at a small premium. The improvement in margins is a key long-term factor as we believe it is defensible due to its deep expertise and developing brand, which when taken in conjunction with industry tailwinds implies long-term value. Offsetting this, however, is that markets have priced a growth story for a number of years and so its future is partially already baked into the share price. Additionally, we are highly critical of its ROE dilution thus far, although we would like to see if Management can execute strategically to see outsized returns play out in the coming years.

Additionally, NV5 is trading within proximity to its peer group, although more toward a discount based on the P/E metrics. Our view is that parity with the market is likely appropriate, although a small discount would not be unjustified. This is due to its scope for growth outperformance on an organic basis being offset by margin weakness and a lower ROE.

Currently, NV5 is trading at a NTM FCF yield of ~8%, 2.0ppts above its historical average. We believe this is a reflection of a change in investor sentiment about its capital allocation, valuing its FCF lower than historically due to the expectation of dilution.

Conversely, this does show the potential for long-term value if capital allocation is better balanced. Investors could see ~4% of this in the form of distributions, while the remaining is invested in M&A and organic growth. At scale, this suddenly appears far more attractive when the business is growing at ~MSDs. As long-term investors, we prefer to look at the business from this lens.

Capital IQ

Key risks with our thesis

The risks to our current thesis are:

- [Upside] Successful expansion into emerging markets.

- [Upside] Meaningful expansion into software services.

- [Upside] Declaration of infrastructure investment by other leading geographies (Similar to the US).

- [Upside/Downside] Strategic mergers and acquisitions.

- [Downside] Economic recession

- [Downside] Failure to retain key talent.

- [Downside] Failed M&A.

Final thoughts

NV5 is a fantastic business in our view. Management has developed the company well, layering expertise and scale, underpinned by an impressive track record of delivering quality services to its clients. The industry is positioned to grow well long term, owing to increased infrastructure spending and growing technological complexity.

We are critical of its capital allocation to date but we concede that it is difficult to value the long-term business model development that comes with a more well-rounded, larger company. This said, going forward, Management should focus its efforts on enhancing shareholder value.