Investment summary

Based on my model, I see a 28% upside to Paycor HCM, Inc.’s (NASDAQ:PYCR) share price (based on the current price of $20.65); hence, I am giving PYCR a buy rating. I believe the recovery in the demand environment and continuous success in penetration of the upmarket segments, combined with the long-term secular growth tailwind, should help it easily beat its FY24 guidance and accelerate growth in FY25. As growth recovers, I expect the market to revalue the PYCR valuation upwards to reflect the growth strength.

Business Overview

PYCR provides SMBs (small and medium businesses) with cloud-based HR solutions through a comprehensive suite of tools. The obvious benefit is that it makes the life of SMBs a lot easier, which means higher productivity. For instance, payroll is automatically calculated instead of calculating everything via spreadsheet. PYCR digital tools also offer the advantage of centralizing data, securely storing, and managing all employee records in one encrypted hub, making it easy for SMBs or any users to find the necessary data instead of pulling out old folders from the cabinets.

PYCR reported its 2Q24 results last week, with revenue growing 20% to $159.5 million, beating street expectations for $155.6 million (300 bps y/y growth beat). Notably, recurring revenue growth accelerated to 18% y/y vs. 16% in 1Q24. While gross margin came in at 67.4%, slightly below street expectation of 68.1%, PYCR did beat on EBIT, with EBIT coming in at $23.3 million vs. street expectation of $20.1 million (15% vs. 13% margin expectation). As of 2Q24, PYCR had a net cash position of ~$47 million.

Demand environment turning favorable

Over the last 4 quarters, PYCR had seen growth deceleration from ~32% in 3Q23 to 20% in 2Q24, which I believe led to many investors being concerned about further growth deceleration (as the macro conditions weighed on business tech spending). This weakened sentiment could also be seen in PYCR valuation (on a forward revenue basis), which declined from ~7.5x to the current 5x, and share price decline from ~$26 at the start of CY2023 to the current ~$20.

However, I think the worst might be over for PYCR, and the market is not pricing this recovery in demand yet. Management called out in their 2Q24 call that demand remains healthy for modern HCM (human capital management) solutions and specifically noted that demand across all three of its customer segments is positive and they are still seeing strong top-of-funnel demand.

In my opinion, the latter comment regarding top-of-funnel demand is a strong leading indicator of growth. Recall that management has continuously noted that they continued to see strong top-of-funnel performance over the past few calls, and I see this as “backlogs” of customers that have the intention to use PYCR but are delaying any commitments because of the uncertain economic outlook. Once the macro situation becomes more stabilized or better (as it seems to be given that inflation has come down and rates are expected to be cut), PYCR should see a gush of conversion from “backlogs” to bookings.

Yeah. I think we’ve seen demand in all three of our segments — the low end of SMB, the mid-market and the enterprise market. We’ve seen really strong top of the funnel demand. So that’s exciting. Nothing’s changed there. 2FQ24 earnings

Yeah, we haven’t seen any changes, it’s been really consistent. What I would tell you is that we’re seeing really strong top of the funnel performance, strong impressions visitors to paycor.com, first time appointments and win rates are consistent. 1FQ24 earnings

We’re focused on continuing to increase our traffic online. And so, I think all of those things are helping drive top of funnel awareness. We’re seeing record impressions, record traffic to paycor.com and record leads. 2FQ23 earnings

Upmarket penetration remains positive

Despite the challenging operating environment, PYCR has continued to see success in penetrating the upmarket (midmarket and enterprise segments), which bodes well for long-term growth. For reference, in 2Q24, PYCR grew customers with >1K employees by 18% year over Specifically, the PYCR embedded HCM solution contributed 200 bps of employee growth in 2Q24, which was double the rate seen in 1Q24 (100 bps contribution).

While the channel only represents ~1% of revenue today, I believe the potential for growth and margin expansion is huge on this front. First of all, the average size of customers is more than 2x the average size of the PYCR customer base today. While pricing is generally lower within this channel given volume discounts, given the customer size, I believe it gives PYCR plenty of opportunities to cross-sell additional modules over time. This cross-sell opportunity should carry high incremental margins given the lower customer acquisition cost (PYCR already has a direct relationship with the customer), which could help drive structurally higher margins in the long term as the solution scales. Furthermore, management noted that the pipeline continues to build.

Guidance is not hard to beat

Management raised its FY24 guidance, with total revenue expected to grow to $653 million at the midpoint vs. the prior guide of $651 million. Pro-forma [PF] EBIT is expected to come in at $106 million at the midpoint vs. the prior guide of $104 million. I believe PYCR should be able to beat this guidance, which will cast a very positive sentiment around the stock.

First and foremost, from a mathematical perspective, the $2 million increase in revenue guidance (at the midpoint) is below the total revenue beat vs. guidance in 2Q24 (management guided for 2Q24 revenue of $155.5 million, which means PYCR beat by around $4 million). It seems to me that management is taking a very conservative stance for 2H24. Also, the guidance assumes flat organic growth among existing customers for the rest of the year. Given that the macro-environment is relatively better today vs. CY2023, and that there is a potential for a rate cut in 2H24, I believe we could see demand accelerate in 2H24 as businesses reset their expectations, turn more positive on the macro-outlook, and thus spend more on technology to prepare themselves for the next growth cycle.

Moreover, from a historical perspective, PYCR has always beaten its own revenue guidance by an average of 4%, which makes me feel even more confident that management guidance this time around might be too conservative.

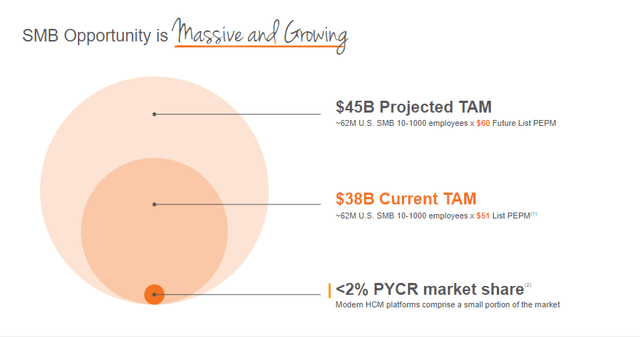

Long-term growth supported by strong secular tailwind

PYCR

Looking farther out into the longer-term growth potential for PYCR, I don’t see any structural change because of this macro environment. On the contrary, I believe this macro environment has sent a strong wake-up call to many SMBs that they need to be cost-efficient in order to ensure they can tide through the next downcycle. One way to do this is to adopt digital tools, like those that PYCR offers, and I believe there is a large room available for PYCR to penetrate. The reality is that many SMBs have inadequate HCM systems, either because they do not have the time or resources (a proper HR department) to manage them or, hence, fall back to using legacy solutions like spreadsheets or pen and paper. I don’t think there is any strong competitive advantage that these legacy solutions have over a cloud-based embedded solution. Legacy solutions are hard to maintain as the business gets bigger, leading to incomplete employee data records and compliance risks.

Also, legacy solutions require manual data entry and reconciliation, increasing error rates and compliance headaches. Hence, late payroll, inaccurate reporting, and weak data security become common issues. Finally, legacy solutions limit SMBs ability to leverage other point-solutions (unable to integrate) like ERP or POS, limiting flexibility and digital ecosystem growth. This combination of factors leaves HR professionals and team leaders buried in manual tasks, unable to effectively manage their workforce and support employee needs. As such, I believe SMBs will eventually adopt modern HCM solutions.

Valuation

Redfox Capital Ideas

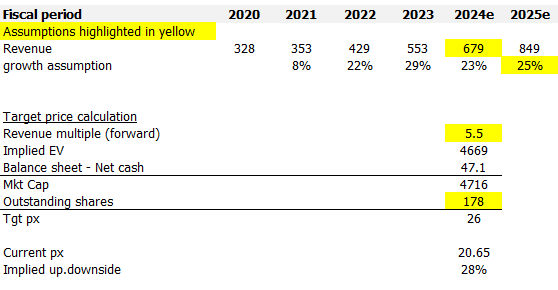

I see a 28% upside to the PYCR share price based on my valuation model. My FY24 $679 million revenue estimate is based on management FY24 guidance of $653 million at the midpoint, combined with my expectation of a 4% beat (in line with historical beat vs. guidance). This translates to a 23% y/y growth for FY24, which I expect to accelerate back to a mid-20% percentage in FY25 as the demand environment continues to recover.

As growth accelerates/recovers, PYCR valuation should trade up to reflect this growth strength. The last time PYCR grew 25%, the shares traded around ~5.5x forward revenue, and I have used that as a benchmark for my assumption. The combination of all of these assumptions led to my target price of $26, which is not a high hurdle to meet given that it has been trading at the $26 level for most of the past 12 months until November last year.

Risk

Investment risks include slower than expected growth recovery if the macro environment does not get better from here, leading to SMBs pushing out adoption until there is more visibility. In this case, there might be a chance for PYCR to miss its guidance, which will put significant pressure on the share’s sentiment as this would be the first time PYCR misses its guidance, damaging management’s creditability. Consensus revenue estimates have largely revolved around guidance, so if PYCR misses, it will most likely cause consensus to revise their estimates downward to be more conservative, putting further pressure on the share price.

As for company-specific risk, PYCR might face execution issues in penetrating the upmarket segment given that the sales motion of selling to SMBs differs from that of larger clients that require more customization and a more direct sales approach. PYCR’s lack of experience in this aspect might cause challenges.

Conclusion

The recent 2Q24 results, with revenue exceeding expectations, signal positive momentum, and despite past growth deceleration, the worst may be over for PYCR. In my opinion, the market appears to undervalue this recovery in demand, as reflected in the current valuation. Upbeat comments from management regarding top-of-funnel demand and success in upmarket penetration also paint a very positive outlook. While risks include macroeconomic uncertainties affecting growth recovery, I recommend a buy rating on PYCR due to the potential for demand recovery and a probable guidance beat.