It’s a new year, which means a fresh start, new goals and … the arrival of tax documents.

If you leaned into your credit card strategy last year and earned a ton of rewards, you may wonder if you’ll need to pay taxes on them. In most cases, no — your rewards aren’t considered taxable income.

But this tax season, we’re seeing reports of people receiving 1099s for some sign-up bonuses. Specifically, many Chase cardholders have received 1099s for sign-up bonuses on Marriott cobranded cards, the Amazon gift card they received as the sign-up bonus on Amazon cards, and for promos or credits they have received through their credit card, as first reported by FlyerTalk and Doctor of Credit.

I feel their pain. I received two 1099’s from Chase this week — one I was expecting and one I wasn’t.

So let’s break down when you should expect a 1099 for your credit card rewards and what to do if you believe you received one in error.

However, we are not tax professionals here at TPG, so if you have further questions, you should contact your certified public accountant.

Are credit card rewards taxable?

Generally speaking, credit card rewards are not taxable. In most cases, when you have to spend to earn rewards, those rewards are not considered taxable income. This means standard welcome bonuses, rewards you earn on your everyday credit card spending and credit card perks like statement credits are usually safe.

The exception to this rule is any bonus you get that doesn’t require spending, including referral bonuses and automatic bonuses for opening a new bank account. Since you don’t have to spend to earn them, these types of bonuses are considered taxable income.

Related: Should I pay my taxes with a credit card?

Daily Newsletter

Reward your inbox with the TPG Daily newsletter

Join over 700,000 readers for breaking news, in-depth guides and exclusive deals from TPG’s experts

Which credit card rewards are taxable?

While most rewards aren’t taxable, one type is: referral bonuses you receive when someone applies for a credit card through your referral link. The bonus is considered income since you don’t have to spend to get these rewards. (Your friend, conversely, wouldn’t need to pay taxes on the bonus they earn for completing that spending.)

Related: How to refer friends and earn points, miles or cash credits

Is cash back taxable?

No, in most cases. A 2010 memorandum from the IRS says cash back earned via credit card spending is not considered taxable income. However, if you receive it as part of opening a bank account where you didn’t have to complete minimum spending, you must report it as income.

Related: The best cash-back credit cards

Are business credit card rewards taxable?

Just like with personal cards, welcome bonuses and the rewards you earn from making purchases on your business credit card are not considered taxable income. However, when claiming business expenses, you can only claim the net cost of an item after any statement credits you receive as a perk from your credit card rather than the full cost before the credits are applied.

Related: The best business credit cards

Are bank account sign-up bonuses taxable?

Yes. Bank account sign-up bonuses are similar to credit card referral bonuses — you don’t have to spend to earn them. This means they’re taxable, according to the IRS. Just like with credit card referral bonuses, there’s no guarantee you’ll get a 1099 for these bonuses, but you’re expected to claim them as income regardless.

Will I receive a 1099 for my credit card rewards?

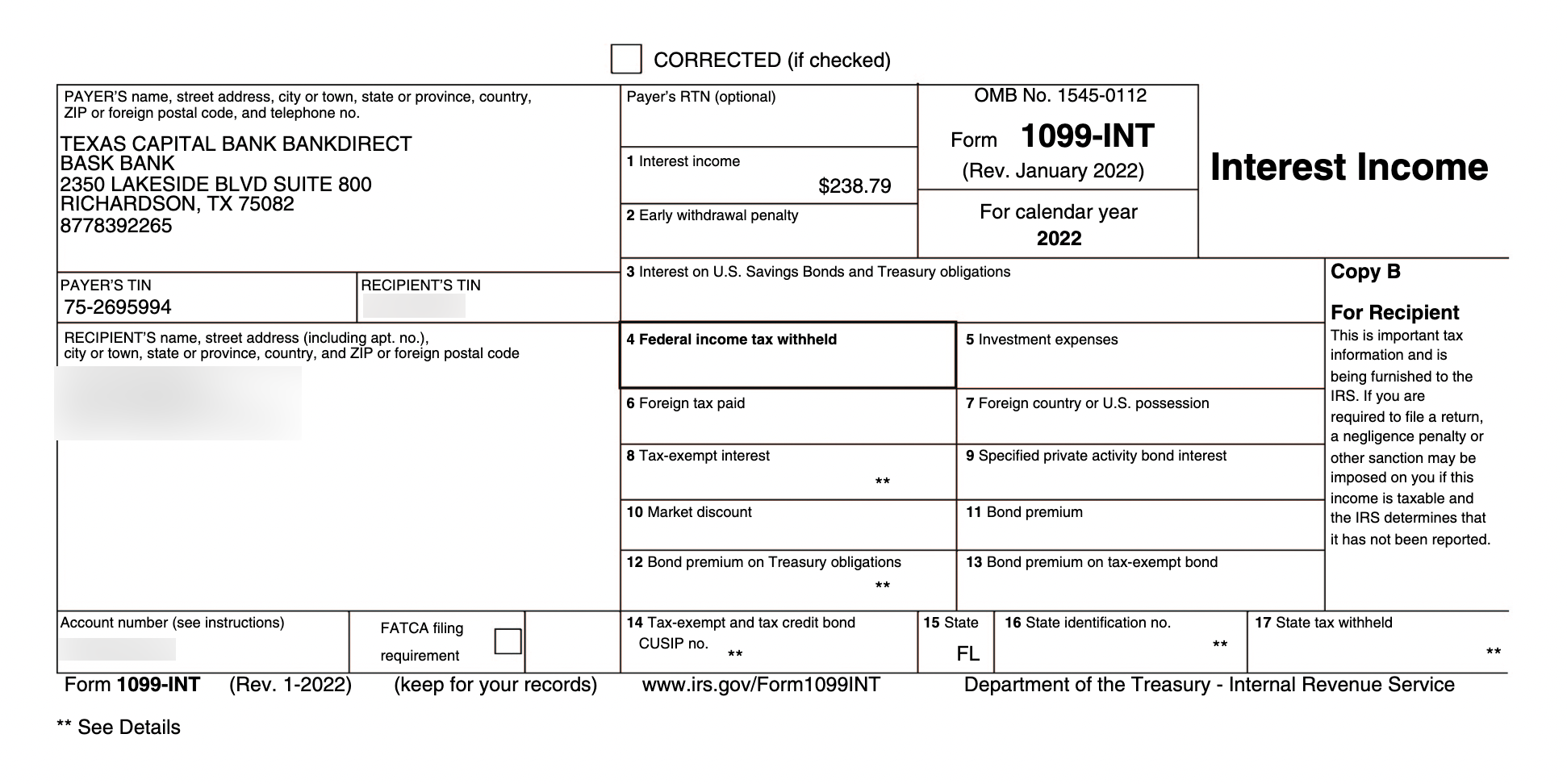

Sometimes, you’ll receive a 1099-MISC or a 1099-INT if a card has given you taxable rewards. A 1099 is a so-called information return document for the IRS that shows the income you’ve received from a third party.

However, not all issuers will send these forms. We recommend keeping your own records since you’ll still need to report all of your income — even if you don’t receive a 1099.

Which issuers send 1099 forms for credit card rewards?

Most major issuers send 1099s for referral bonuses worth $600 or more. If you don’t get a 1099, you can request one from your bank or estimate the income. Even if the bank doesn’t send one, you must still report the income to the IRS.

Despite the general rule that you’ll only get a 1099 for referral bonuses, Capital One has also sent them in recent years for statement credits. They appear to be treating these as gifts, which can be taxable.

Additionally, in 2024, some have reported getting a 1099 from Chase for the Amazon gift card they received as a sign-up bonus on Amazon cards. I got my card during October’s Prime Day and received a $150 gift card as my bonus. Sure enough, I got a 1099 for the $150 in the mail this month, in addition to a 1099 for the Chase referral bonuses I got last year.

TPG senior credit cards editor Matt Moffitt received a 1099 from Capital One for his referral bonuses from 2023. He received 100,000 Capital One miles for four referrals, which Capital One valued at 1 cent each. As a result, his 1099 was for $1,000 in taxable income.

Many are also reporting receiving a 1099 for their Marriott bonus of five free nights, which we haven’t seen in the past.

You can contact the issuer for clarification or correction if you receive a 1099 that you believe was in error.

Historically, banks have treated statement credits and bonus points as rebates on spending, which the IRS does not view as taxable income. So far, we haven’t seen major issuers make this move consistently, but we’ll keep an eye on it. If sign-up bonuses and statement credits are regularly taxed, that will go into our evaluation of a card’s net value year over year.

Related: Capital One expands benefits it considers taxable

Where do I report 1099 income?

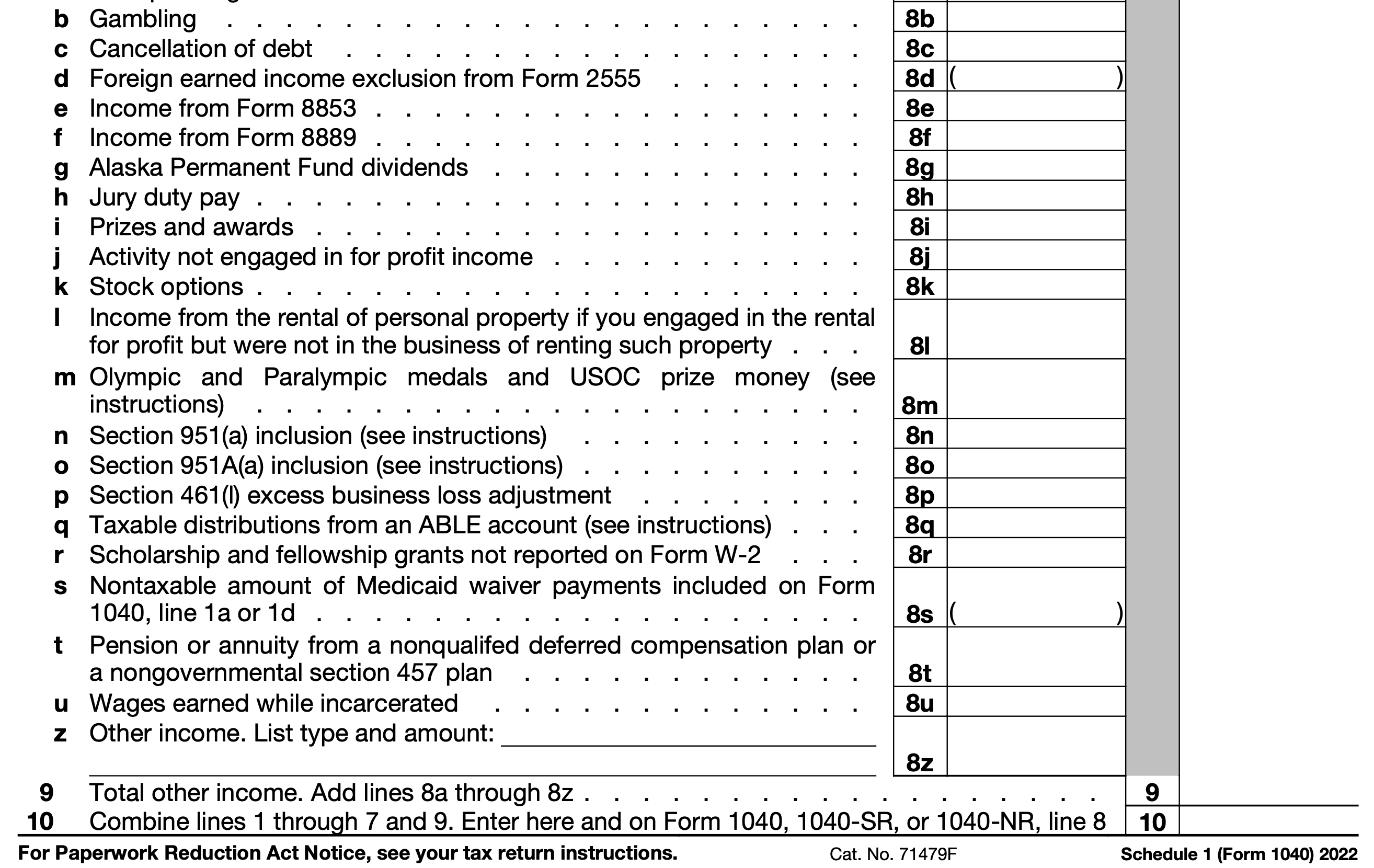

You should include the income under the heading “Other income” on line 8z of your 1040 as reported under the “Other income” from Schedule 1, line 22.

Bottom line

Even if you’ve earned thousands of dollars worth of rewards this year through credit card welcome bonuses and everyday spending, you generally won’t have to pay taxes on those rewards. However, you must pay taxes on rewards from referral bonuses or opening a new bank account. Keep your own notes on these sources of income, as the bank may not send you a 1099 for these earnings.