picture alliance/picture alliance via Getty Images

Dear readers,

My investment in Aurubis (OTCPK:AIAGF) (OTCPK:AIAGY) thus far has been lackluster. The combination of thieving and an expected downturn in the 2024E fiscal has really sent this German cyclical lower, to where my position is now in the red even with dividends and FX included in the calculation.

In this article, I’ll be updating on Aurubis and tell you why I am still investing heavily into this business, and expect to add to my position as it hopefully keeps declining further, upping the yield here and making the company more interesting. As I said before, the decline in the company does not bother me. It would do so if the overall implication was that I on a 5-10-year basis paid far too much for this investment, but that is not the implication that we currently have for the company.

I still think that the copper space is an overall great space to be in. Yes, it’s cyclical. Many of the investments I’ve made are cyclical and are looking at a tough 2024-2025 period, but my timeframe is far longer than this. I haven’t been in Aurubis overly long – so any decline I have here is relatively small.

Let’s look at what we have here – and we have the 1Q23/24 report because this company has a somewhat different financial calendar than other companies.

You can find my last article on Aurubis here.

Aurubis – Updating for 1Q24

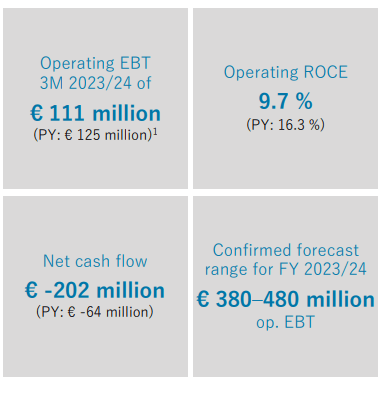

Overall, I expected things to be worse for Aurubis. ROCE was down significantly, but this was expected – and the company’s operating EBT came in above €100M, despite many of the challenges seen today. The number was influenced in part by good treatment and refining charge levels on the concentrate side, with good premium for copper, and the wire rod and other product demand levels coming in significantly higher than I expected market conditions to allow. (Source: Aurubis 1Q24)

Aurubis IR (Aurubis IR)

So what’s the ROCE problem? Ongoing investment CapEx and some negative closing trends from the last quarter, and the net cash flows are now at a negative €200 because inventories are being built up.

Why is Aurubis building inventory, aside from good demand in certain products? The company is expecting a shutdown in Hamburg, which will require the company to maintain higher levels of inventory.

All of the financial KPIs that matter were negative for the quarter, with the exception of gross profit, which was up 3%. Again, this negativity was to be expected given the combination of impacts we’re seeing here. As before, Aurubis remains a play on overall macro market conditions – and here are some of the more important trends to keep an eye on.

Some of the influences here are going lower – Aurubis being a major consumer of energy, lower energy costs (almost 25% lower) is a very solid trend, thanks to both hedging and transactions, as well as introduced caps for energy prices in certain of the companies market, like Bulgaria.

Fundamentals for this company also remain strong. The company’s debt coverage, meaning the company’s net financial liabilities/rolling EBITDA remains below the company’s 3x target, at 0.2x. Aurubis used to be negative here when things were better, but it’s still very solid here.

Aurubis remains a 2-segment play. Multimetal recycling, number one, saw the highest amount of stability, only down a few percent, with a ROCE still above 13%. Custom Smelting & Products saw ROCE declining to 11.5%, and more issues despite an increased quantity of processed material in almost every segment.

This illustrates Aurubis encountering similar challenges to other companies, where costs are higher than whatever volume increases or gross profits companies manage to eke out. This is also characteristic for the company’s expectations for the 2023/2024 market outlook.

On the positive side, Aurubis is well-supplied and prepared to handle the entire year’s season in terms of input materials for copper concentrates. Smelters are at high capacity here. However, recycling is expected to go down – there’s an expected downturn in overall supply due to economic slowdown, which also trickles down to something like recycling – but secondary Aurubis smelters already have plenty of material to process into 3Q, so 2 quarters on a forward basis.

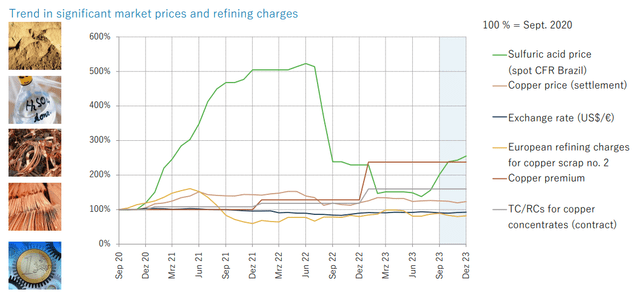

Sulfuric Acid, which the company sells, was one of the upsides about 24 months ago. It no longer is an upside. With the stabilizing demand here and development in sales prices, based on revenues, we can expect this not to be a major contributor to any increase for the coming year.

The one upside that’s clear is the wire rod. The demand here is expected to stay at a very high level, while rolled and shaped product demands, due to macro, are expected to be low.

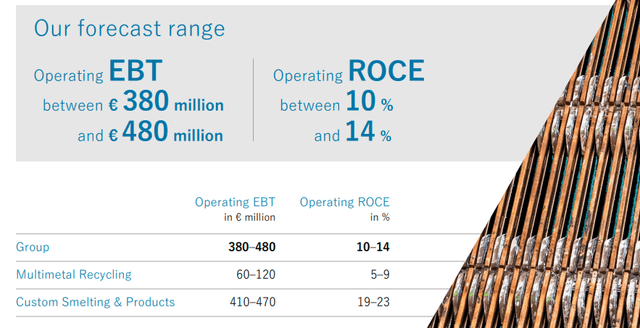

Here is the FY outlook.

If the company does manage to go back to 14% ROCE, that would be a feather in its cap, but I expect closer to a 10%-11% given the current macro trends, and an operating EBT of below the €410M mark, with custom smelting coming in lower than expected.

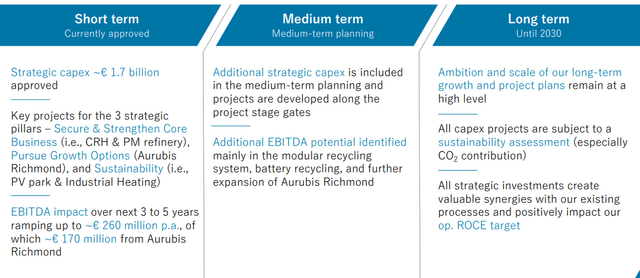

The positives for Aurubis are very forward-looking, and based on multiple strategic investments and projects, which should catapult Aurubis into a very bright future in 3-6 years.

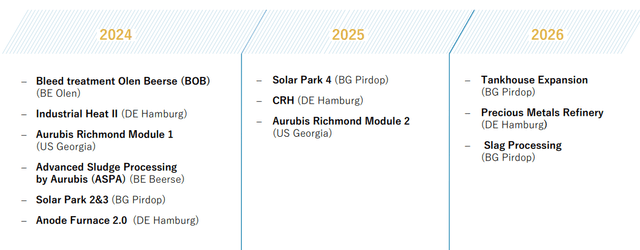

The company’s pipeline is an impressive set of projects, including Aurubis Richmond, ASPA, BOB, Industrial Heat II in Hamburg, The 2.0 Anode Furnace, expansion of the tank house, and the Complex Recycling facility in Hamburg, known as CRH. All of these things, and more, are currently in implementation, with the following timeline.

Look at, for instance, how the Richmond Facility is shaping up already.

Many of these projects will take years to materialize their full earnings and EBT impacts, of which there is no doubt. But the picture that I want to convey when presenting Aurubis for 2024, and for the latest quarter here, is a company that is extremely forward-looking. That is why my investments in the business are done in small batches but at a steady pace. I do not expect this to see a significant immediate upside.

That’s fine. This company is going to grow slowly, but it’s going to grow sustainably going forward. Aurubis Richmond is a good poster project here, with the first milestones already achieved. Remember, this facility saw ground broken after COVID-19 in early June of -22. That means what you see above has all been done in less than 2 years. The start of the cold commissioning of the first module is in less than 4 months.

The company also went ahead and slightly lowered the dividend to €1.4/share, which means we’re back to 20/21 levels, and I don’t see the company upping it much for next year either, at least not unless we see the significant forecasted improvements for this year.

Aurubis is a company in the process of improving.

Let’s look at what we have in terms of valuation, and what upside we can see for the long term – why the company is expected, by me, to return over 100% in the longer term.

Aurubis Valuation – Upside Exists, but only in the Longer Term

A few changes to the valuation are justified here. First of all, I would now consider the company cheap inching closer to a €60/share native price target. If you recall, my conservative PT for the company was €80/share, and I’m not bumping it here – but nor am I cutting it.

But the upside here is significantly better than in my last article.

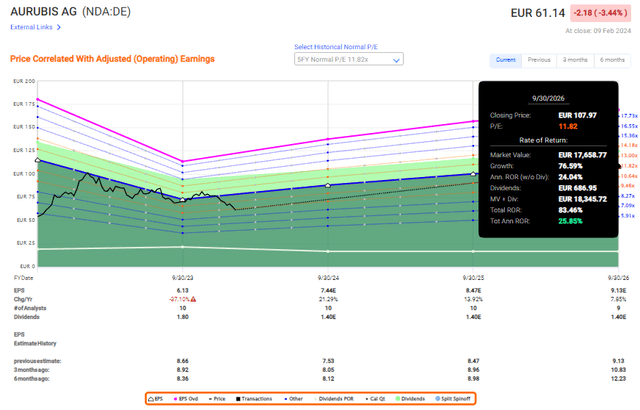

I would say that Aurubis is worth at least 11-12x P/E, as a cyclical with a forward expected EPS growth rate in the double digits, and a historical 5-year P/E of around 11.5x.

Aurubis Upside (F.A.S.T graphs)

As you can see, even a very conservative forward calculation here means that we’re looking at something like 80%+ RoR in less than 3 years. This also implies a far higher upside in terms of PT than what I am conservatively calculating at this time. But you could use my conservative PT to forecast at around 9.4x P/E, which by the way is close to the normalized P/E multiple we have today, and still come out with 16% annualized RoR, above my target of 15%. And that is with the company not increasing the dividend a single time until 2026E from the current level.

So you can see why at €60/share, the company is a company that has a compelling short- and longer-term upside, and one potentially worth investing in.

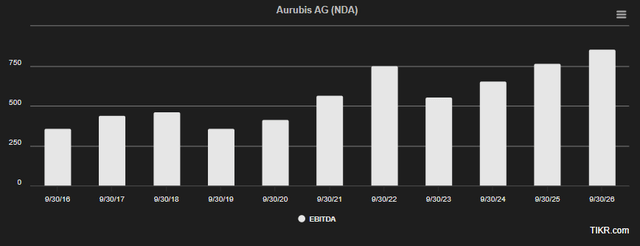

S&P Global gives this company, at this time, a range starting at €68/share and going up to €110/share, with an average of €85/share. Out of 9 analysts, 6 are either at a “BUY” or similar positive rating, and the expectations are for Aurubis, over the next years, to manage a considerable overall increase in company EBITDA, with 2023, the year that we just left behind, acting as a bottom or a trough for the trends. (Source: S&P Global, TIKR)

Provided that Aurubis normalizes at these forecasted levels in EBITDA, it’s also likely we’ll see some of the forecasted increases in EPS and dividends as well, though we’d be conservative in expecting the dividend not to go above €1.6/share for the foreseeable future, based on this company’s significant expansion plans.

It’s important to note that the expectations you’re seeing above in the forecasts are what I would consider the bearish or baseline scenario. A bullish Scenario for Aurubis which could see the company rise to 13-14x P/E would entail the 100%+ RoR that I see, and I want to make it clear that I would not “SELL” Aurubis at anything below €120/share if it came to that.

I think this is one of the cheaper and more compelling long-term plays in this space, and I also say that the news of the theft and the ongoing process against the people who perpetrated this have colored the share price for the company for some time here.

Because of that, I say that this is a “BUY” and give you my 2024E thesis for the company.

Thesis

- Aurubis is a market-leading German metallurgy company in the segment of copper, other non-ferrous metals, and precious metals, as well as the byproduct of Sulfuric Acid. The company has one of the most extensive expertise on the planet for this particular field, and it deserves more than the attention it’s getting here at this time.

- As of the latest quarterly report, some of the expectations for 2024E are somewhat more crystallized, and what I would consider clearer than before. This enables us to act with more confidence and also maintain our PT and positive stance for this company.

- I say that Aurubis remains a “BUY” at around €80/share or below for the common. I have looked at options plays available for this company, but for the time being, would not consider this to be relevant due to low premiums.

Remember, I’m all about:

1. Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

2. If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

3. If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

4. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

There are still enough positives here, and I would now also argue the company is getting closer and closer to “cheap”.

This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.