aprott/iStock via Getty Images

Introduction

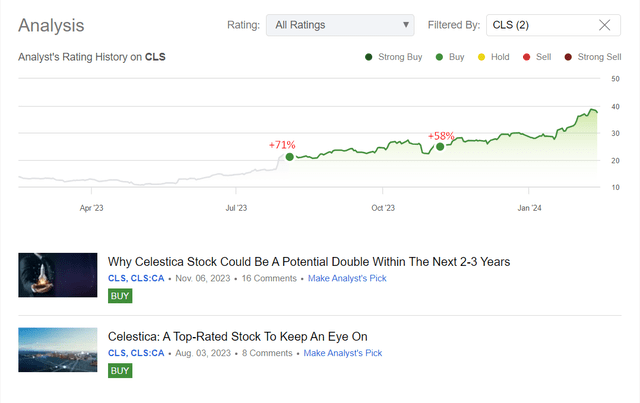

In August 2023, I initiated coverage of Celestica Inc. (NYSE:CLS) stock and then confirmed the ‘Buy’ rating again in November. Since then, CLS has proven to be one of my most successful calls, if you annualize the stock’s actual performance and compare it to other small caps in the sector.

Seeking Alpha, the author’s coverage of CLS

Since it’s been a whole quarter since I last looked at Celestica, I figured it’s time to get back and analyze its latest financial results and current valuation. That way I can assess how tempting the stock might be at the moment.

The Recent Financials And Corporate Events

If you’re just learning about Celestica Inc., it’s a company based in Toronto, Canada, with a market cap of ~$4.5 billion as of February 13, 2024.

They specialize in supply chain solutions spanning North America, Europe, and Asia. According to their latest press release, Celestica operates through 2 key segments:

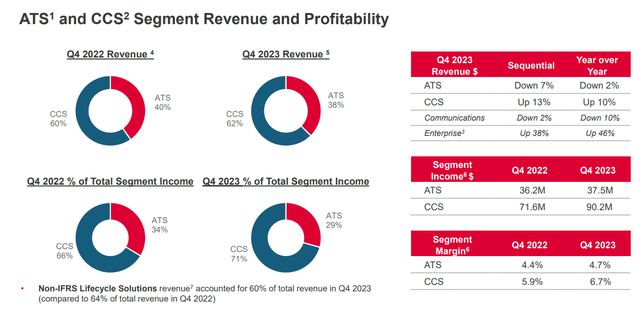

Advanced Technology Solutions [ATS] – 38% of total revenue – delivers cutting-edge supply chain solutions to customers in industries such as Aerospace and Defense (A&D), Industrial, HealthTech, and Capital Equipment.

Connectivity & Cloud Solutions [CCS] – 62% – focuses on providing supply chain solutions to customers in communication and enterprise sectors, particularly those involving servers and storage.

In other words, the company provides a wide range of product manufacturing and supply chain services, including design, engineering, component sourcing, electronics manufacturing, testing, logistics, and after-market repair. They also offer hardware platform solutions and management services for various industries, such as aerospace, defense, HealthTech, capital equipment, and communication and enterprise markets.

Despite a slight decline in revenues in the ATS segment in Q4, Celestica achieved record-high margins, marking the highest quarterly results in its history. The ATS segment revenue was down 2% YoY, mainly due to demand softness in the industrial business and ongoing market challenges in capital equipment. However, solid growth in the Aerospace and Defense (A&D) business partially offset these declines. Celestica’s overall performance in FY2023 was exceptional, with revenues reaching ~$8 billion, driven by strong growth in both segments.

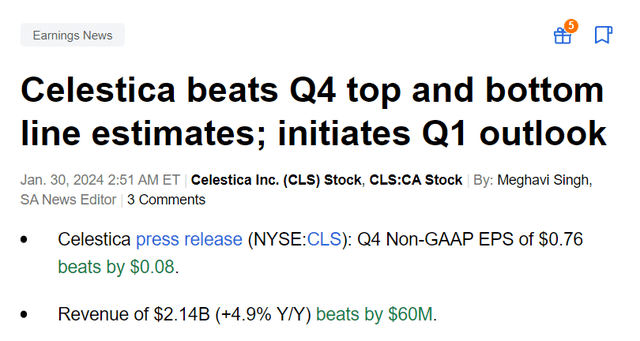

With revenues reaching $2.14 billion, the company surpassed the high end of its guidance range, while its non-IFRS adjusted EPS stood at $0.76, surpassing the high end of the guidance as well. Additionally, Celestica achieved a non-IFRS operating margin of 6%, which exceeded the midpoint of the guidance ranges. As a result, the company easily beat the consensus estimates of Wall Street analysts for Q4:

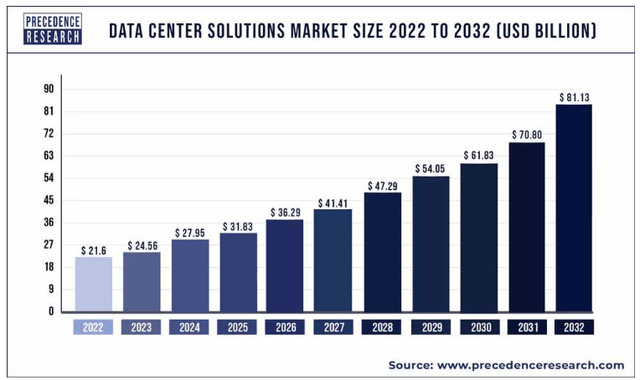

As I understood from the latest earnings call transcript, Celestica’s strategic initiatives for FY2024 include an increase in CAPEX to support capacity expansions at key sites. Expansion projects are underway in Thailand and Malaysia to meet the growing demand for specialized data center products. Indeed, according to Precedence Research, the global data center solutions market was valued at $21.6 billion in 2022 and is expected to reach ~$81.13 billion by 2032, growing at a CAGR of 14.20% (2023-2032), which is a lot.

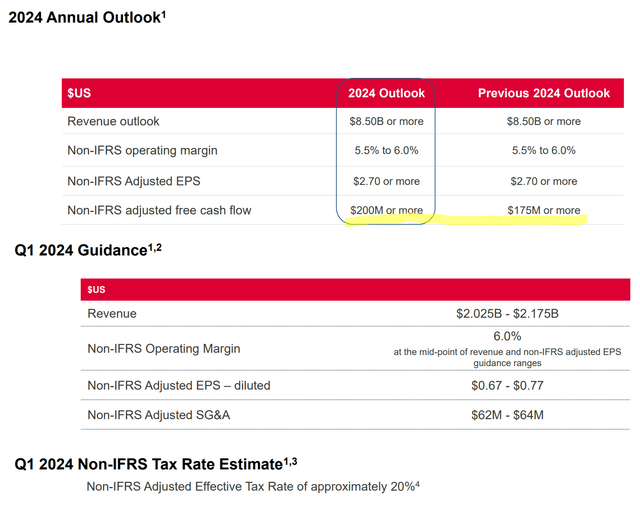

The company expects to generate adjusted free cash flow (non-IFRS) of at least $200 million in 2024, an increase from the previous outlook. Celestica will continue its share buyback program as it believes this is a good use of capital. In addition, the company has reaffirmed its financial outlook for FY2024 and expects revenue of at least $8.5 billion, adjusted EPS of at least $2.70, and an operating margin between 5.5% and 6%.

CLS’s IR materials, author’s notes

In my opinion, CLS still has room to grow from an operational efficiency perspective (especially in terms of margins) and the current business momentum is likely to continue over the next few years. However, how attractive CLS stock is after the 175.74% rise in the last year depends on the company’s current valuation.

Celestica’s Valuation Update

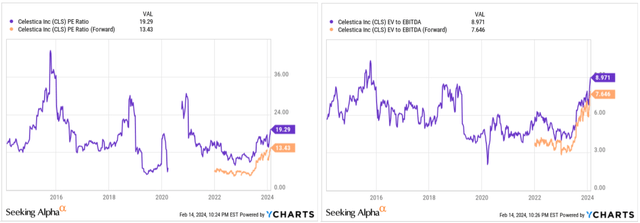

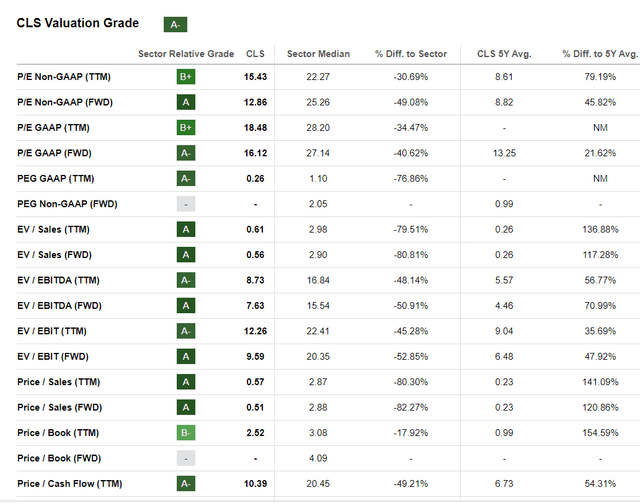

From what I see today, CLS’s valuation multiples have “reached normality” so to speak, i.e., they have moved from the strong undervaluation that prevailed at the beginning of my coverage of the stock into the fair valuation range with a P/E and an EV/EBITDA of 13.4x and 7.6x (both forwarding ratios):

However, according to Seeking Alpha Premium data, the company’s valuation multiples are still at a significant discount to industry norms, which still makes CLS a very, very attractive investment in the medium and long term.

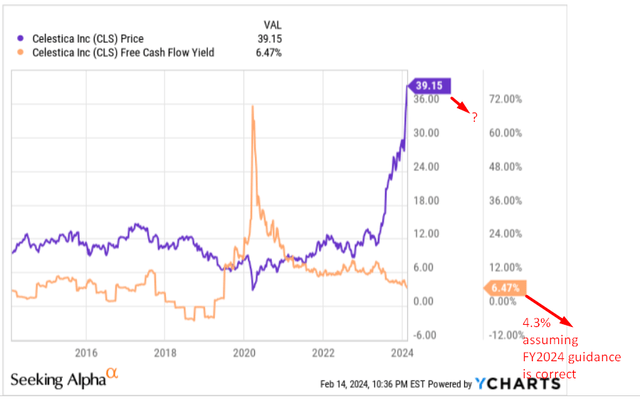

But despite CLS’s relatively low multiples, I am concerned that the company plans to spend a lot of cash on CAPEX in the future, which will result in a limited FCF generation from the maximum possible. Even today, CLS’s FCF yield is only 6.47%, which is significantly lower than six months ago. Based on the FCF forecast for FY2024 ($200 million), CLS’s FCF forwarding yield is likely to fall to 4.3% – a negative sign for the stock in my opinion. I do not rule out a correction or an extended consolidation before CLS stock rises sharply again.

The Bottom Line

Celestica stands out as a compelling mid-cap player within the North American IT market. With an attractive addressable market poised for growth, coupled with relatively modest operating margins, there exists ample room for expansion in the future. So longer-term CLS definitely looks like a ‘Buy’ despite some crucial risks.

However, I am a bit concerned about Celestica’s FCF growth prospects shorter term. The company will have to spend quite a lot of money on expansion, which will most likely have a positive impact on the future, according to the latest statements from the management. But this potential limitation on FCF streams may result in overvaluation at some point based on the FCF yield, which I like the most among all other metrics.

It may take much longer for the market to allow CLS to grow as fast as before. Therefore, I expect a price consolidation after the lightning growth in recent months – nobody has canceled the mean reversion.

In light of these considerations, I have decided to downgrade the CLS stock today from ‘Buy’ to ‘Hold’.

Thank you for reading!