As the name suggests, REITer’s Digest is dedicated primarily to the real estate industry. As of late, a significant portion of my professional time is spent discussing, assessing, and forecasting the impacts of the developing changes in the real estate market (VNQ). Accordingly, this content and discussion has leaked into my coverage and content on Seeking Alpha.

I fundamentally believe in real estate as an investment. Admittedly, my opinions are biased given my professional connection to the industry. Having spent most of my time working with commercial properties, I believe they are a worthy asset and investment. At the same time, I am troubled by emerging trends in the commercial real estate sector. Specifically, there are overlaps between the lead up to the Great Financial Crisis and the current circumstances. I find myself wondering, does history repeat itself or just smell the same?

Let’s look back at the Great Financial Crisis and examine some overlapping sentiments. Over a year before the bankruptcy of Lehman Brothers, banks began announcing losses linked to subprime mortgages. Large banks announced balance sheet losses, while smaller regional specialists began to close. However, the real carnage did not begin until well after then Federal Reserve Chairman Ben Bernanke gave a now infamous speech in March 2008 reassuring the market of the integrity of the financial sector. Bernanke assured investors that sub-prime loans and the housing market were isolated concerns and did not pose a threat to the financial sector in totality. Keep this phrase in mind.

Yet, just five months later, Lehman Brothers failed in large part due to its exposure to subprime lending. The failure of Lehman initiated the greatest financial crisis in history. The bank’s failure marked the world’s entry into the Great Financial Crisis.

Today

Now, jump forward to today. On February 4th, Fed Chair Jerome Powell was interviewed by 60 Minutes, discussing the economy and monetary policy. In that interview, Powell made assertions similar to those of Bernanke in 2008.

I don’t think that’s likely. So, what’s happening is, as you point out, we have work-from-home, and you have weakness in office real estate, and also retail, downtown retail. You have some of that. And there will be losses in that. We looked at the larger banks’ balance sheets, and it appears to be a manageable problem. There are smaller, regional banks that have concentrated exposures in these areas that are challenged. And, you know, we’re working with them.

Powell assured the market that the problems surfacing in commercial real estate are manageable and isolated to smaller, regional banks. Sounds familiar.

The Federal Reserve believes ongoing issues stem from pandemic-related trends such as work from home and online shopping. I believe they run much deeper as long-term capitalization rate compression (based on the belief interest rates would remain perpetually low) contributed to the unsustainable climb in property values. The climb was mostly isolated to premier assets such as CBD office and multifamily. Despite acknowledging that many regional banks are in trouble, there’s no indication that the Federal Reserve intends to divert monetary policy. As it stands, the Fed’s inflation target of 2.00% will continue guiding movements of interest rates.

The Fed has been banking on a soft landing since the consensus turned to recession. The Federal Reserve cannot afford a commercial mortgage crisis which would jeopardize the stability of the economy. Politically, timing is problematic for the administration given the upcoming election. Stability is key. I think the Federal Reserve’s assurances that these are isolated issues only affecting heavily concentrated regional banks are as credible as they were in 2008. The skepticism does not draw on my healthy distrust of blanket optimism, but rather the size of the possible debt crisis.

Implications

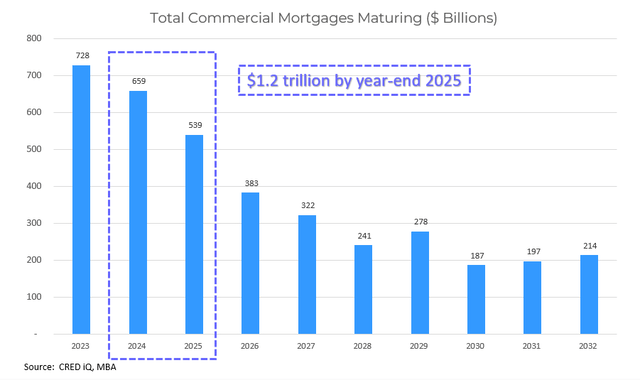

CRED iQ

According to CRED iQ, there are approximately $1.2 trillion in commercial mortgages maturing over the next two years. Falling property prices and elevated borrowing costs could inhibit property developers and owners from rolling over the maturing loans without debt restructuring efforts. Some property sectors have been more deeply impacted than others. For example, the office sector has fallen by as much as 40% since the pandemic. The decline in value presents a significant problem as owners move to refinance given many of these properties are highly levered. Loan to value ratios will skyrocket upon refinancing forcing parties to either face the music or continue the “extend and pretend” charade.

While impossible to accurately predict what losses could look like, the reduction in commercial property values across office, multifamily, retail, and other property types could result in meaningful loan losses for lenders. According to a study from the National Bureau of Economic Research,

Commercial real estate (CRE) loans…account for about [a] quarter of assets for an average bank and about $2.7 trillion of bank assets in the aggregate. Using loan-level data we find that after recent declines in property values following higher interest rates and adoption of hybrid working patterns about 14% of all loans and 44% of office loans appear to be in a “negative equity” where their current property values are less than the outstanding loan balances.

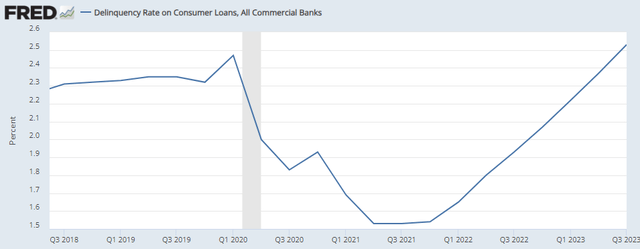

Provisions of this size would be difficult under any circumstances. Conditions are already tough for banks as they continue eating losses from various business units. Furthermore, the situation is compounded by the aggressive monetary policy implemented over the past two years which has caused default rates across consumer loans to increase.

FRED

The pressure stemming from monetary policy was sufficient to cause regional banks to fail. With other headwinds beginning to mount, we may not be out of the woods. Should the existing pressures be compounded by losses stemming from trillions in commercial loans, the infection could fester.

Conclusion

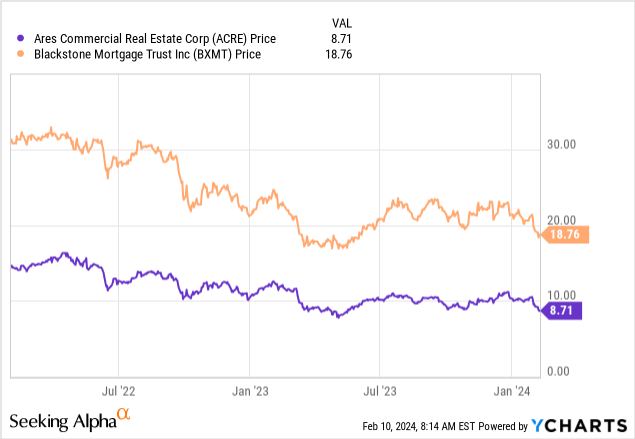

It is only natural for the Federal Reserve to take a position of strength and confidence. After all, they are responsible for running and maintaining monetary policy. If they lack confidence, the system will take notice quickly. Reading between the lines, drawing on history, and questioning the narrative are valuable during turbulent and uncertain times. Data clearly reflects that we are not out of the woods. The looming chaos will affect all banks to some degree. Additionally, the losses will continue to hammer mortgage REITs such as Ares Commercial Real Estate (ACRE) and Blackstone Mortgage Trust (BXMT).

The next year will prove a pivotal point for the future of real estate. If the industry can survive the pressures being exerted by investors and the Federal Reserve, it will become a tale of triumph. However, until that point, we must remain vigilant about the impending risks.