I am updating my previous analysis on PLDT Inc. (NYSE:PHI) in light of updated news on inflation and two-quarters of SIM card regulations impacting the company.

I previously rated PLDT a hold with balanced risk and reward, calling out the following drivers:

- Upside potential from depressed valuation multiples and steady growth

- SIM registration deadline potentially decreasing wireless volume

- Inflation squeezing margins

I noted that a favorable resolution to either inflation or SIM card could push me to a buy.

Since then, PHI has been essentially flat, dropping 0.9%, while the S&P 500 returned 12.1%. It is also down 8% across the past year.

PHI Price Trend (Seeking Alpha)

While inflation in the Philippines has improved significantly, rate and volume in the core business continues to struggle. In addition, the guidance suggests a lower price target of $17 in addition to dividend risk. Despite the upside potential from growth business, I lower my rating from hold to sell until the business drivers and dividend stability improve.

Inflation Has Improved Significantly

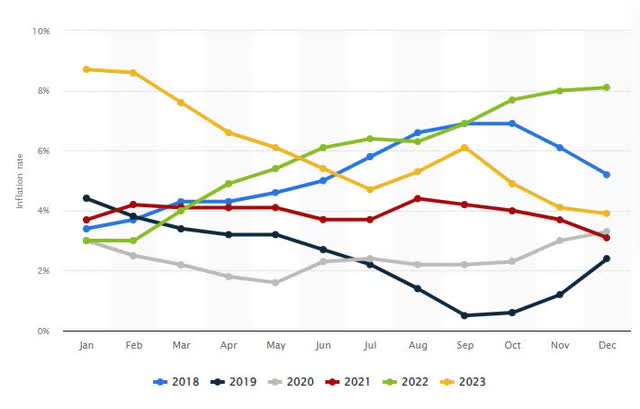

During my last analysis, I noted that inflation over the prior 12 months had run at 7.5%, easing down to 6% over the previous few months.

Philippines Inflation (Statista)

The Philippine’s Finance Secretary reported today that inflation fell to 2.8% in January within their target range of 2.8%.

This is great news for PLDT, as inflation started quickly reducing its EBITDA margin in 2022, dropping from 53% to 51%.

EBITDA Trend (PHI Investor Relations)

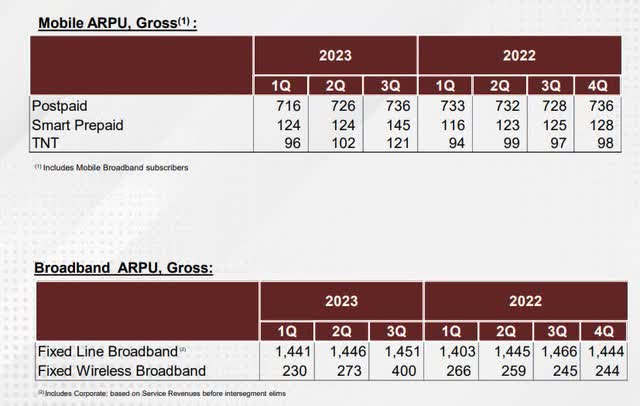

Unfortunately, despite inflation, they have not been able to drive much in the way of ARPU.

PLDT Inc. ARPU (PHI Investor Relations)

Through aggressive cost cutting, they have been able to grow back to 52% and 53% throughout 2023. Since inflation eased faster and debt costs are expected to begin decreasing, this should be a lift on profitability all around.

Volumes Continue To Struggle

As a reminder, the Philippines approved a new law in 2022 that requires SIM cards to be registered to a user in order to activate. The final deadline for compliance was July 2023.

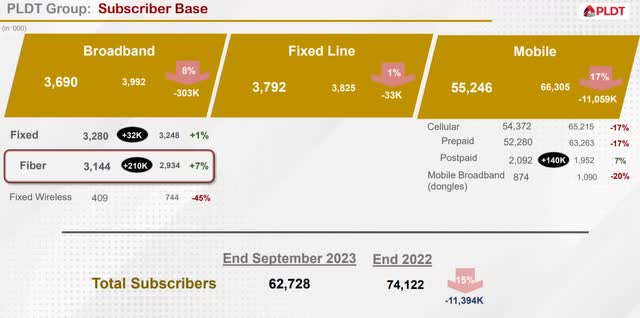

While management was optimistic in earlier earnings calls about getting existing users registered, volumes have suffered compounding the ARPU issue mentioned above. Overall subs declined 15%, driven by SIM card-based services fixed wireless, prepaid cell, and mobile broadband with some offset from postpaid mobile and fiber. Keep in mind that the Philippines is heavily weighted towards prepaid. In cellular alone, prepaid represents more than 90% of subs.

Subscriber Base (PHI Investor Relations)

While the company is certainly seeing success in Fiber and Postpaid, high-margin services, it’s just too small a portion of the business to offset declines.

While growth businesses such as data centers and Maya Bank are promising, corporate data revenue is down 17% year-over-year, and Maya Bank is still operating at a substantial loss.

I see a significant risk for continued declines in the core business before new businesses can catch up. While cost cuts have driven EBITDA this year, it is unlikely they will find significantly more opportunity in future years.

Guidance Suggests Lower Target And Dividend Risk

Here is a reminder of the most recent guidance from management:

- 2023 service revenue growth low single-digits

- 2023 EBITDA low-single-digit growth

- Dividend payout at 60%

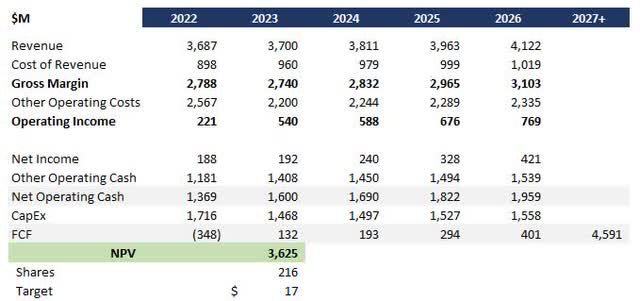

With several new businesses, like Maya bank, in play, this guidance fell below my expectations. I updated DCF analysis using the following overarching assumptions:

- 4% short-term revenue growth with weakness in core business slightly offset by growth in new business

- 2% cost growth to account for carryforward of G&A efficiencies

- 3% long-run growth rate in line with Philippine market

- 12% discount rate with higher risk-premium due to lower profitability and cash flow

This DCF generated a price target of $17, 27% downside from today’s pricing.

PHI DCF (Data: SA; Analysis: Author)

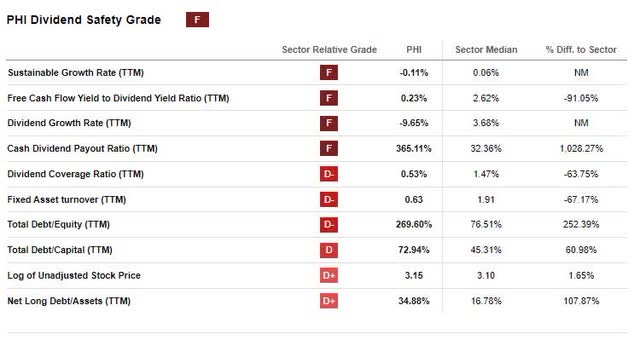

The dividend adds additional risk to the price target. The quant rating has flagged PHI as high-risk for a dividend cut, with an F for dividend safety.

PHI Dividend Safety (Seeking Alpha)

Management’s guidance for 60% dividend payout already risks dividend growth due to the stagnant guidance for profitability.

As discussed above, the core cash flow driving business is struggling on both rate and volume. While capital intensity is being scaled back, growth businesses are more capital intensive and management may need to put their foot on the gas to grow. I would agree with the dividend safety that increases to the dividend are unlikely and cuts are quite possible.

Verdict

The core business is struggling on both rate and volume with stagnant ARPU and a 15% decline in overall subscriber volumes, particularly impacting the largest business area: prepaid cell. While there has been some success in fiber and postpaid segments, these areas are too small to compensate for the broader declines in the subscriber base.

Additionally, while new ventures such as data centers and Maya Bank present growth opportunities, their current performance—corporate data revenue falling by 17% and Maya Bank operating at a substantial loss—highlights the challenges PLDT faces in diversifying its revenue streams effectively.

Management guidance suggests low single-digit service revenue and EBITDA growth, with a dividend payout at 60%, falling short of my expectations and previous analysis. My updated DCF, taking into account the ongoing struggles in the core business and possible scenarios for new business growth, sets a price target of $17—a 27% downside from current levels. The dividend is also at high risk of cuts.

Despite a significant improvement in inflation rates within the country, a trigger I previously mentioned would raise my rating; I am lowering my rating from hold to sell due to growing challenges in other parts of the business.