The stock price of Prospect Capital Corporation (NASDAQ:PSEC) cratered 7% last Friday after the business development company reported quarterly earnings.

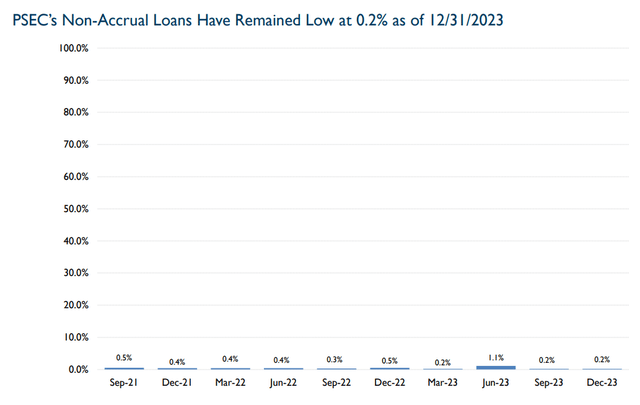

The stock price meltdown is a little hard to comprehend when taking into account that Prospect Capital’s dividend was once again well-covered by the company’s net investment income and the non-accrual ratio, a measure of troubled loans, remained exceptionally low at 0.2% in the last quarter.

Though Prospect Capital suffered a 3.6% decline in its net asset value, I think passive income investors have a unique opportunity to gobble up shares on the cheap, and capitalize on even higher discount to net asset value.

My Rating History

The market mentality that caused Prospect Capital’s stock to lose nearly 7% of its value is hard to follow, particularly when taking into account that the earnings release was way more positive than it was negative.

My stock classification for Prospect Capital is Buy. Prospect Capital’s very high discount to net asset value, despite maintaining a rather robust credit profile, is more than enough justification for me to be a buyer here.

Well-Diversified Portfolio With An Exceptionally Good Non-Accrual Situation

As I have said before, Prospect Capital is selling at a large discount to net asset value because of the company’ spotty record when it comes to paying a dividend. However, even a lower-quality BDC like Prospect Capital can be in a Buy setup which I think it is after the stock price inexplicably dropped 7% on Friday.

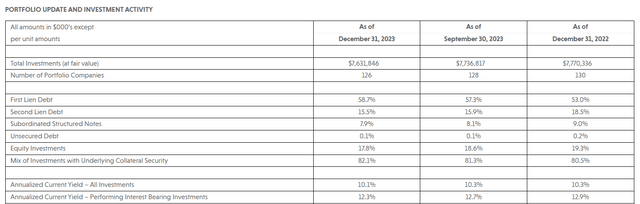

Prospect Capital’s total portfolio value, as of December 31, 2023, was $7.6 billion which makes the BDC the fifth-biggest BDC available for passive income investors to invest in.

Prospect Capital’s First and Second Liens accounted for 74.2% of investments, based on fair value, compared to 73.2% in the prior quarter. The BDC conducted $171.7 million in gross originations, which was up 31% QoQ.

With originations growing and the portfolio performing well in terms of non-accruals, I think that passive income investors did not have a good reason to be a seller on Friday.

Portfolio Update And Investment Activity (Prospect Capital)

In 2Q-24 Prospect Capital’s non-accrual ratio was 0.2%, the same it was the quarter before. The low non-accrual ratio, which shows passive income investors that Prospect Capital’s loan portfolio is performing according to expectations, is a primary reason why a Buy classification can be justified in my view.

Combined with a rather strong coverage profile, I think that the risk/reward relationship for PSEC on the drop is rather favorable.

Non-Accrual Loans (Prospect Capital)

Prospect Capital’s Financial Results For The Last Quarter And NAV Impact

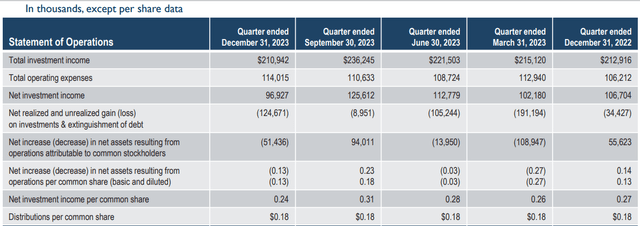

Prospect Capital produced $210.9 million in total investment income in the last quarter, which was flat YoY. The company’s operating expenses increased 7% YoY to $114.0 million and Prospect Capital’s recognized $124.7 million in net realized and unrealized losses in Q2’24 which negatively impacted its net asset value.

In general, Prospect Capital had a fairly predictable December quarter and though the BDC’s net asset value dropped by a small percentage point, the company’s dividend coverage remained exemplary.

Statement Of Operations (Prospect Capital)

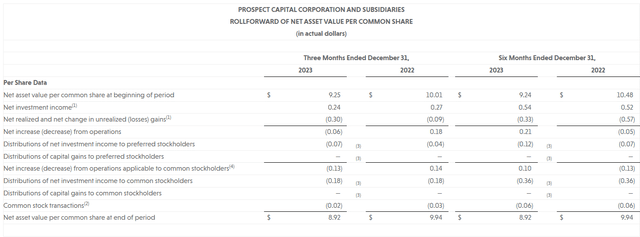

Prospect Capital’s net asset value fell 3.6% QoQ, from $9.25 in 1Q-24 to $8.92 in 2Q-24. This drop in net asset value was related to investment losses that affected the BDC to the tune of $0.30 per share in Q2’24.

Prospect Capital’s net change in unrealized gains (losses) amounted to $124.7 million, compared with $34.4 million in the same period a year ago.

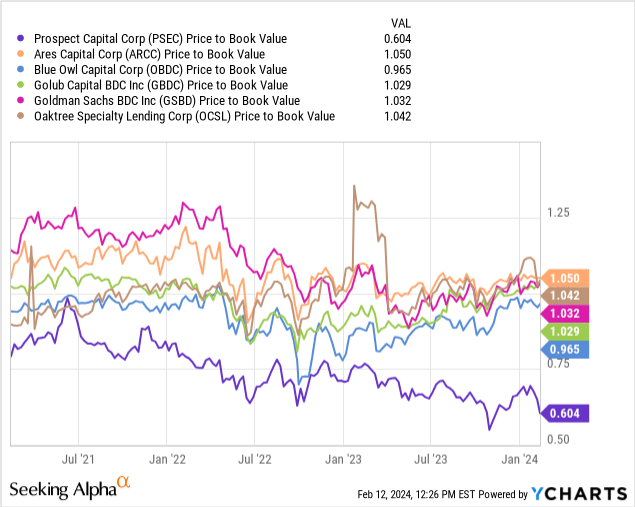

The drop in net asset value continues Prospect Capital’s long-term record of a falling net asset value, which is one of the reasons why the market prices PSEC’s book value at 61 cents on the dollar.

Net Asset Value (Prospect Capital)

Prospect Capital’s Dividend Is Safer Than You Might Think

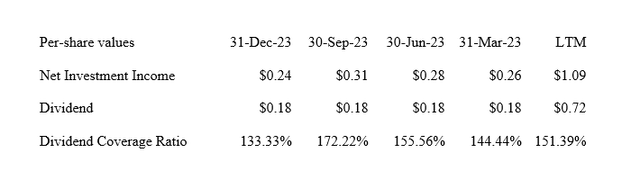

I am not the biggest fan of business developing company Prospect Capital, but I must say that the present dividend pay-out metrics look pretty decent to me: Prospect Capital’s investment portfolio produced $0.24 per share in net investment income in 2Q-24 which equates to a dividend coverage ratio of 133%.

This coverage ratio reflects a high margin of safety, and I think that the dividend is quite well protected at the present net investment income level. The $0.06 per share per month dividend represents a yearly dividend yield of 13.3% which makes a purchase here particularly lucrative for passive income investors in my view.

Dividend (Author Created Table Using BDC Information)

Expanded Discount Valuation

Prospect Capital’s discount valuation expanded after Friday’s 7% valuation haircut, leading us to a net asset value discount of 40%.

Of course, Prospect Capital, as I mentioned in my previous reports on the BDC, does not have the best dividend records, has high real estate exposure (about 18% of the portfolio) and has seen a long-term decline in its net asset value.

However, even under explicit consideration of Prospect Capital’s weaker-than-average dividend track record, I think that the 13% yield is quite safe and not at risk of getting slashed in the short-term. Thus, I think the 40% net asset value discount is exaggerated, and I added 25% to my Prospect Capital long position on Friday.

A conservative estimate for Prospect Capital’s intrinsic value is its net asset value, which stood at $8.92 per share at the end of December. Taking into account Prospect Capital’s low non-accrual ratio, I don’t particularly see why the BDC should be priced at such a high discount to net asset value.

Why My Investment Thesis May Be Off

Yes, Prospect Capital’s net asset value declined QoQ which was probably the only thing that really stood out in a negative way. The low non-accrual ratio represents a good indication that the BDC’s loan portfolio is rather well-performing, and excess dividend coverage doesn’t indicate at all that the dividend is poised for the chopping block.

With that being said, an increase in non-accruals would probably cause me to reevaluate my stance on Prospect Capital, as would a declining margin of dividend safety.

My Conclusion

Prospect Capital’s 2Q-24 was good, and the stock should not have tanked as it did.

The trend on the most important figures is a positive one as Prospect Capital maintained top credit quality with a non-accrual ratio of 0.2% and dividend coverage in excess of 130% continues to reflect a high margin of dividend safety.

Prospect Capital’s stock now sells for 0.61x net asset value, which seems quite a bit exaggerated when put into context with the fundamentals discussed in this article.

I think the valuation itself provides a high margin of safety, and I have added on Friday to my investment in Prospect Capital by 25%. Buy.