Sundry Photography

Written by Nick Ackerman.

Texas Instruments Incorporated (NASDAQ:TXN) doesn’t make the exciting and flashy chips that power artificial intelligence, or AI. They are not catching any of those headlines that we’ve been consistently seeing from the other side of the chip world, namely Nvidia (NVDA).

Instead, they make the boring chips that are used in everyday equipment all around us. This tends to make them more sensitive to the overall economy and the outlook of where we could be heading on that front. Given the Fed’s desire to slow down the economy in an effort to try to tame inflation, the macroeconomic outlook would be for a weaker economy going forward.

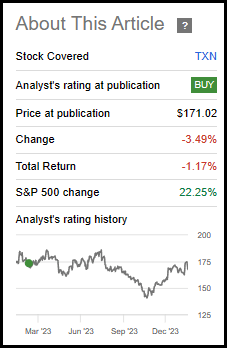

That’s been the theme of the last year as well. When we previously discussed this name, they were essentially in the same situation they are now, as analog chips continue to have a weak demand. Perhaps it is unsurprising, then, to see that shares on a total return basis have essentially moved nowhere since that prior update.

TXN Performance Since Prior Update (Seeking Alpha)

Still, I believe that Texas Instruments is still worth investing in. Perhaps even more worthwhile, as every day goes by, we should be getting closer to that inevitable recovery for the company.

Latest Results And Forward Outlook

Reflecting on the continuing reality of weakness in the chip space, Texas Instruments recently posted their latest quarterly results and noted weakness in the industrial space. Revenue in the automotive segment was also seen as soft and declining, though that was after previously strong growth. Here is the recap from their Q4 earnings call:

First, the industrial market was down mid-teens as we saw that increasing weakness. The automotive market was down mid-single-digits after 3.5 years of very strong growth. Personal electronics was about flat. And next, communications equipment was down low-single-digits. And lastly, enterprise systems grew low single digits.

Industrial and automotive make up the bulk of TXN’s total revenues, as they noted these contributed to 74% of 2023’s revenue.

The TXN Q4 results weren’t awful in terms of expectations. The company saw a slight beat in terms of EPS and a fairly light miss on revenue estimates. That did represent a revenue decline of 12.6% year-over-year, even if it was only a light miss of analyst expectations.

The guidance of expecting weakness to continue, along with soft guidance that missed estimates for Q1, sent shares downward. Clearly, the latest results are going in the wrong direction for shareholders and company growth. With a continued outlook remaining soft in 2024, the short term didn’t provide any confidence either, and shares sold off after the initial release. It also likely didn’t help that TXN shares were heading meaningfully higher into the earnings report, either.

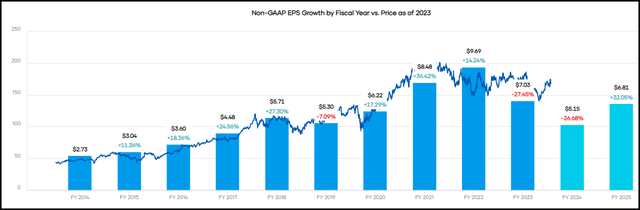

However, in the longer term, looking out to 2025, analysts believe that a return to growth can take place.

TXN Earnings History (Portfolio Insight)

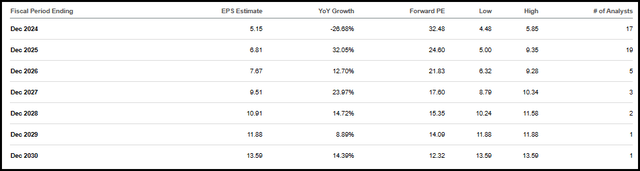

Going out even further beyond 2025, analysts expect that recovery will continue with earnings growing all the way through 2030. However, it should be noted that 2029 and 2030 only have a single analyst’s expectation. The nearer-term years can have a bit more weighting, as there is a larger number of analysts providing consensus.

TXN Earnings Estimates (Seeking Alpha)

This all points to a recovery that is likely to take place in the future. Given the shorter-term outlook of the next year, it would appear that TXN is significantly overvalued.

TXN Fair Value Range (Portfolio Insight)

The company is carrying a forward P/E of nearly 32.5x. That can be compared to the historical P/E range of 21x to 28x.

That said, if the earnings estimates do start to get hit looking further out, P/E can start to come down quickly. In fact, in 2025, we would see the forward P/E come in at less than 25x – putting it right near the middle of the historical fair value range. Going out to 2026, we are pushing below 22x, indicating a level near the bottom of its historical fair value range.

That’s all only if the company delivers on the current estimates. TXN has a long history of beating most quarterly earnings estimates. With earnings revisions moving massively lower, it looks like that could indicate setting the company up for that trend to continue. However, when the recovery does start to take hold, we will likely start to see upward revisions. Right now, Texas Instruments is in a rough period, and I believe that’s when it is worth buying.

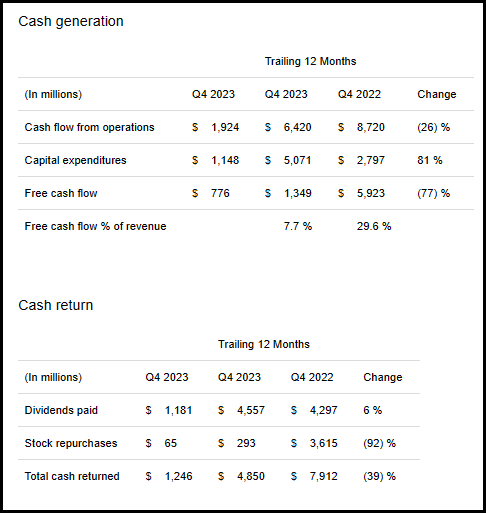

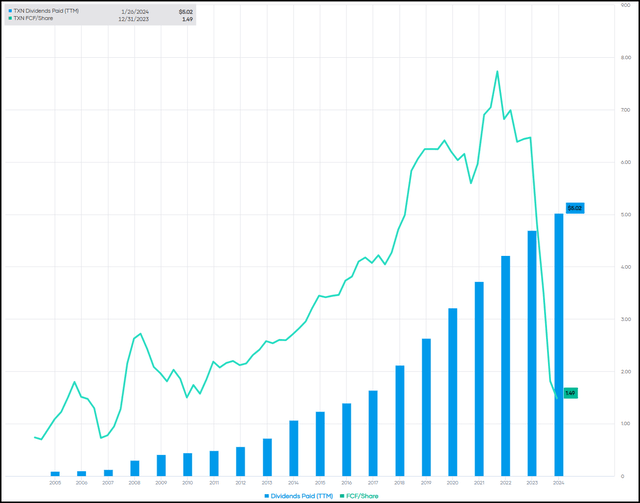

Dividend

Free cash flow also took a substantial hit with the latest quarter, and has been trending lower in the last couple of years. However, that isn’t too surprising, as it simply follows the overall downward trajectory of earnings and revenue for the company. In the latest quarter, free cash flow, or FCF, came to $776 million compared to the $1.246 billion returned to shareholders. For the year, we saw FCF at $1.349 billion relative to the $4.85 billion returned back to shareholders.

They scaled back nearly all of their stock repurchases, likely in an effort to balance this shortfall.

TXN Cash Generation Vs. Cash Return (Texas Instruments)

So, that means coverage of the dividend has been weak. We are now at a time where FCF is no longer covering the dividend.

At the same time, I don’t believe that they will be looking to cut the payout just yet – at least if they themselves can also take a longer-term outlook and see a return to growth going forward.

The company has a history of raising its dividends, and that history goes back 20 years. That includes just in Q4 – when they normally increase the dividend – seeing a 5% bump. I don’t believe they’ll want to see this trend of growing dividends end.

TXN FCF/Share Vs. Dividend (Portfolio Insight)

Further, it was a significant ramp-up in CAPEX and not just cash flow from operations alone that took a hit on the company’s FCF in the latest year. Cash flows from operations declined 26%, but the CAPEX increased 81%, resulting in a 77% decline in FCF.

This was brought up in the latest conference call as well, when an analyst asked about the FCF being below the dividend level.

Here was the CFO’s response:

first, I would point you to our operating cash. Our business model is very strong and our operating cash flow is very strong and it supports our investment for growth through the cycle. So clearly with the levels of CapEx that we have right now, that hits the free cash flow. But big picture understand and look at the operating cash, even in a depressed environment with the revenue, depressed operating cash flow is very strong. We also have very strong balance sheet. And we just finished the year at $8.6 billion. You know, when it comes to repurchases, I would take you to our objectives on capital management for cash return, and our objective is to return all free cash flow via dividends and repurchases. Each one of those has different objectives on dividends and repurchases, but we have a really good track record over many years of doing both of those.

They plan to continue with CAPEX at this level, too, through 2026. Like most companies, they continue to invest for future growth. So, that means the relief on that side of the equation isn’t going to end in the short term. On the longer-term horizon, it should eventually taper downward.

On the other hand, it could mean dividend growth could pause should recovery not take hold as expected or be something like the token penny raise. That could likely be a prudent move in an effort to keep the company’s balance sheet sound.

Conclusion

Being that the analog chip company is out of favor – continuing to post weak results as recovery takes longer and longer, and guidance for 2024 isn’t too much prettier – I believe it presents a compelling time to consider adding to one’s position or initiating a position. That is, if one at least believes a turnaround and recovery in the analog chip space is coming in the next year or two.

I am not sure when a bottom will be in, but that’s where utilizing a dollar-cost average approach could be appropriate. Picking up and adding to a Texas Instruments Incorporated position over the coming year could help even with some shares at higher prices but also lower prices should they come.