Investment Thesis

I think there is an excellent investment opportunity in the bond market, and the same favorable scenario applies to any ETF backed by fixed-income instruments. The Vanguard Intermediate-Term Bond Index Fund ETF Shares (NYSEARCA:BIV), which holds investment grades fixed income instruments, is an excellent option for low-risk profile investors who want to benefit from a stabilizing or lowering interest rate environment, as has been indicated by the Federal Reserve.

In the United States, the Federal Reserve (Fed) has increased the federal funds rate to fight high inflation rates, and it is close to achieving a 2% inflation target rate. Once the Fed accomplishes its goal, the federal funds rate will start to drop and cause lower bond yields, leading to an increase in the price of Vanguard Intermediate-Term Bond Index Fund ETF Shares.

Introduction

This article will explain why the Vanguard Intermediate-Term Bond Index Fund ETF Shares is an excellent opportunity. The first part will explain the ETF composition and, subsequently, the relationship between the Vanguard Intermediate-Term Bond Index Fund ETF Shares and the 10-Year Treasury Notes. The second and most important section will examine fundamental data to explain why you should consider this investment instrument.

First Part

ETF Composition and Sector

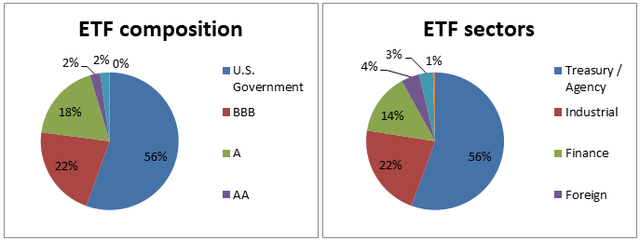

The Vanguard Intermediate-Term Bond Index Shares is an ETF that tracks a market-weighted bond index with five- to ten-year maturity; as of February 2023, the average time to maturity is 7.2 years. The ETF comprises 55.58% government bonds, 21.56% BBB-rated bonds, 18.32% A-rated bonds, 2.39% AA-rated bonds, 2.19% AAA-rated bonds, and minus 0.4% NR-rated bonds.

Image was created by the author with data from Vanguard

For those unfamiliar with the subject, bonds rated AAA, AA, AA, and BBB are investment bonds, which implies that institutions that issue the instruments are in a solid financial position to repay their obligations. Based on a study from 1996, these bonds have less than 0.1% default probability in a year. Meanwhile, U.S. government bonds, on the other hand, have a default probability of 0% because the government can print money to pay off its debt as a last resort.

By sectors, the Vanguard Intermediate-Term Bond Index Fund ETF Shares has the following composition: treasury bonds account for 56%, industrial 22%, finance 14%, foreign 4%, utilities 3%, and others 1%. It is worth mentioning that the ETF is linked to the American economic system, having government bonds and bonds in the industrial and financial sectors.

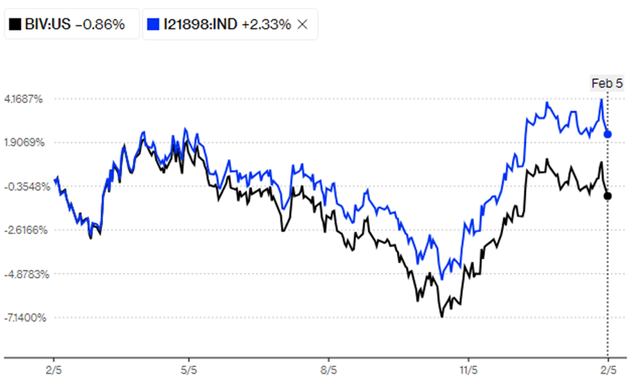

bloomberg.com

The Vanguard Intermediate-Term Bond Index Fund ETF Shares (black line) has underperformed its benchmark (Bloomberg U.S. 5-10 Year Government/Credit Float Adjusted Index), in part due to the expense ratio and the sampling technique to replicate the benchmark; a red flag is the gap between the ETF and its benchmark; in one year, there was a difference of more than 3%. Currently, the ETF has a lower yield than the 1-Year Treasury Bill. The expense ratio is 0.04%, and similar funds have, on average, an expense ratio of 0.57%. Finally, the assets under management are $37.75 billion.

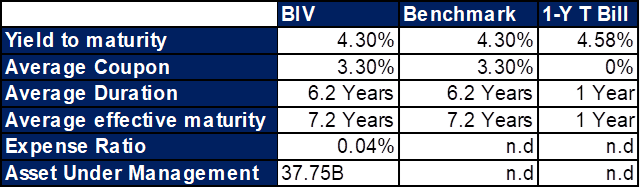

Image was created by the author with data from iShares.com

Vanguard Intermediate-Term Bond Index Fund ETF Shares and 10-Year Treasury Note

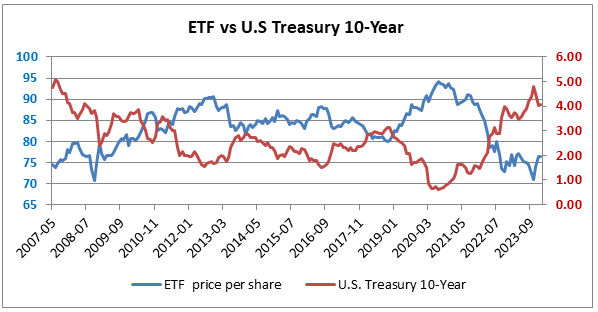

Before moving to another section, it is essential to note that the Vanguard Intermediate-Term Bond Index Fund Shares is an ETF, which means that every certain period, it is necessary to rebalance it to track the Bloomberg U.S. 5-10 Year Government/Credit Float Adjusted Index, which is the underlying asset. As a result, the instruments in the weighted basket do not remain in the ETF until maturity.

Explaining how the Vanguard Intermediate-Term Bond Index Fund earns or loses value is important because you will understand how the Fed announcement affects this financial instrument. Imagine an investor purchases a government bond with five years to maturity, and it pays a 4% coupon per year; in parallel, suppose two possible scenarios: one month after the purchase, the first scenario, the government issues a bond with a 5% coupon, the second scenario, the government issues a bond with a 3% coupon.

In the first scenario, the bondholder will lose money because if he had waited one month, he would have earned 1% more in interest; there is a difference between receiving 5% of $1000 ($50) instead of earning 4% of $1000 ($40). In the second scenario, the investor will be in a better financial position; at a 3% coupon rate, the investor would receive $30, which is $10 less than he would have received at a 4% coupon rate.

It is time to see the relationship between the Vanguard Intermediate-Term Bond Index Fund ETF Shares and the 10-Year Treasury Note. Keep in mind that one of the components of the ETF is the 10-Year Treasury Note. The following chart shows a negative relationship between the two financial instruments. When the 10-years Treasury Note yield decreases, the ETF price per share increases. This situation arises because of the negative relationship between a bond’s price and yield.

Image was created by the author with data from Federal Reserve Bank of St. Louis and Yahoo Finance

The bottom line is to understand the underlying factors that influence the 5- to 10-Year Treasury Notes; for that purpose, it is necessary to analyze the federal funds rate.

Second Part

The Fed

The Federal Reserve System is an institution that aims to maintain financial and monetary stability in the U.S. To achieve this goal, the Fed employs monetary instruments to promote maximum employment and stable prices in the United States. Therefore, when inflation is high, the Fed intervenes to reduce it to its long-run target level.

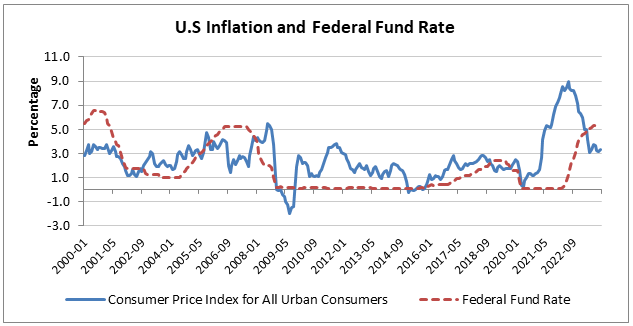

The inflation rate is currently one of the main priorities for the Fed. As a consequence of the coronavirus outbreak in 2020, there was a sharp increase in the annual inflation rate, reaching values that had not been seen in more than two decades; in the following chart, even before the financial crisis of 2008, the inflation rate had not reached the values of 2022.

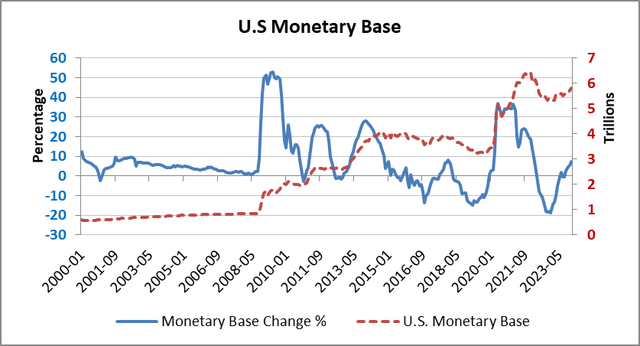

In 2020, the U.S. saw a drastic economic decline due to the lockdown; to counteract that, the Fed reduced the federal funds rate to below 1% and increased the monetary base. The monetary base, or MO, increased by more than 100% between September 2019 and December 2021.

Image was created by the author with data from Federal Reserve Bank of St. Louis

With high inflation and without the lockdown, the Fed’s priorities changed. From March 2022 to the present, the main problem has shifted to fight inflation; for this reason, the Fed decided to curb the economic activity level, incrementing the federal funds rate. Additionally, in 2021, the Fed started to reduce the monetary base with the scope to reduce the stimulus injected into the U.S. economy. That trend has lasted until the present.

Image was created by the author with data from Federal Reserve Bank of St. Louis

Fed Policy in 2023

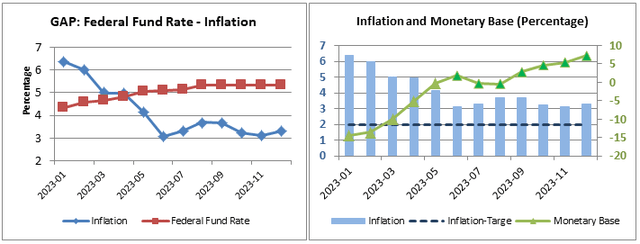

I want to concentrate my analysis on January-December 2023 because you will gain more insight into the Fed policy. First, it is important to examine the relationship between the federal funds rate and inflation; from May 2023 until now, the federal funds rate has been higher than the inflation, indicating a positive real rate in the United States economy; as of December 2023, the gap between the federal funds rate and inflation was 2%. A U.S. Government bond in the secondary market with one year to maturity has a 4.57% yield, which means your investment will gain purchasing power if you buy a treasury bill. By increasing the federal funds rate, the Fed aims to reduce the money circulating into the economy; less money means fewer transactions in the U.S. economy, reducing inflation pressure.

Image was created by the author with data from Federal Reserve Bank of St. Louis

During 2023 and January 2024, the Fed announced a 2% inflation target; the current inflation yearly rate is 3.1%, so another decline of 1.3% is necessary to reach the 2% target. The previous chart shows how inflation has declined, but since June 2023, it has fluctuated around the 3% range. The Fed has been careful about increasing the interest rate because it does not want to hurt the economy. However, there is a reason that explains why the inflation has not declined. Again, from June 2023, the monetary has increased, in December 2023, the annual variation was 7.2%.

From my perspective, it is possible to see another increase in the federal funds rate, which can be between 0.25% and 1%; however, I see values over 0.5% to be unlikely because the inflation needs a 1.3% decline to achieve the 2% inflation target.

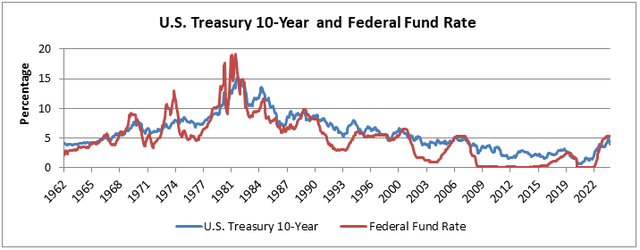

Federal Funds Rate versus 10-Year Treasury Notes

As commented in a previous section, the 10-Year Treasury Note is a proxy to evaluate the performance of the Vanguard Intermediate-Term Bond Index Fund ETF Shares. So, in this section I will examine the long-run relationship between the federal funds rate and the 10-Year Treasury Note.

Image was created by the author with data from Federal Reserve Bank of St. Louis

Establishing a long-run relationship between variables is essential in finance because it helps to find patterns that appear over and over during the years.

The previous chart clearly shows a relationship between the federal funds rate and the 10-Year Treasury Note. When there is a sharp decline in the federal funds rate, the 10-Years treasury bond yield declines. An interesting consideration is the periods in which the federal funds rate (red line) is higher than the 10-Year Treasury Note; you will note that when the federal funds rate declines, there is also a decline in the 10-Year Treasury Notes.

Risk

TradingView

Vanguard Intermediate-Term Bond Index Fund ETF Shares has a price per share of $75.86; from my perspective, when the Fed shifts its strategy and starts to reduce the federal funds rate, it is possible to see an increase in the ETF up to $88 in 3-5 years, which represents a 16% gain. You should add in bond coupons around 2-3.5 percent annually.

In a worst-case scenario, prices can decline to around 70.5%; I took this number based on the historical data. If this event happens, you will lose 7.07%.

Conclusion

The high-interest rates in the United States are a direct consequence of the Fed’s efforts to reduce inflation, which led the institution to an increase in the federal funds rate to 5.25%-5.50%. However, based on the analysis presented in this article, the Fed will probably finish its high-interest rates policy in the upcoming months. This change will cause a decline in the United States Treasury Notes yields, leading to a rise in the Vanguard Intermediate-Term Bond Index Fund ETF Shares price per share.

Last but not least, the Vanguard Intermediate-Term Bond Index Fund ETF Shares has as a characteristic that its constituents are investment-grade bonds; it is a secure investment, so you will not see excessive increases or declines in its price per share.